Former top Barclays banker loses appeal against FCA ban on holding senior roles

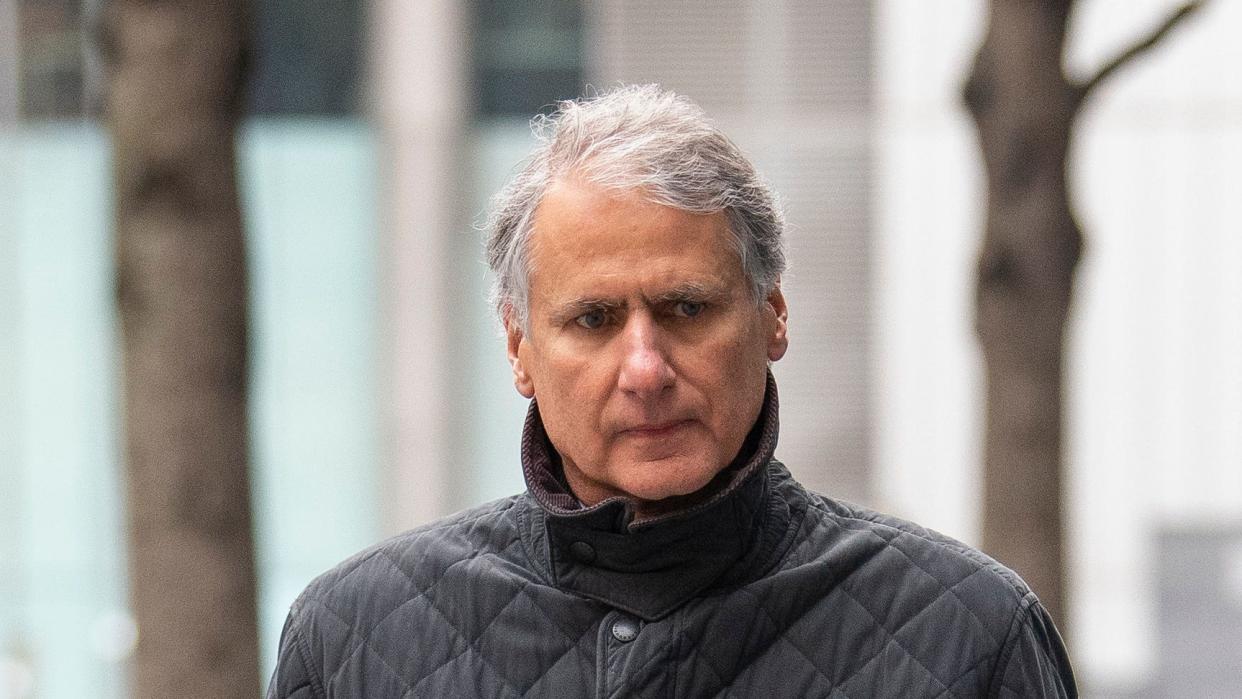

Former Barclays wealth boss Thomas Kalaris has lost his appeal against a decision banning him from holding senior roles in the industry after he was found to have acted dishonestly when questioned about the bank’s capital raising at the height of the financial crisis.

Mr Kalaris – who was acquitted of fraud charges in 2020 – had sought approval to head up the investment firm he co-founded, Saranac Partners, as chief executive but the move was blocked by the Financial Conduct Authority (FCA) in 2022 after the watchdog said he had failed to be open and transparent in two different investigation interviews, and therefore was not considered to be fit and proper to lead the firm.

The ex-chief executive of Barclays’ wealth arm had challenged the FCA decision, which centres on two interviews as part of the regulator’s investigations into Barclays’ controversial capital raising from Qatar in 2008.

The Upper Tribunal in London upheld the FCA’s decision on Tuesday, finding Mr Kalaris was “dishonest” in one of his answers when quizzed by the FCA.

Laura Dawes, director of authorisations at the FCA, said: “We welcome the tribunal’s ruling.

“It unanimously found that Mr Kalaris was dishonest in two enforcement interviews the FCA conducted into events that occurred during his time at Barclays.

“He is therefore not fit to be a senior manager in a business regulated by us.

“It is vital financial firms are led by those who are honest, transparent and who act with integrity.”

Saranac Partners said it was “disappointed” by the tribunal decision.

A spokesman for the firm added: “The matters at issue pre-date the establishment of Saranac Partners and are completely unrelated to the firm and its work.”

The law firm representing Mr Kalaris was also approached for comment.

Barclays declined to comment.

Mr Kalaris – who left Barclays in June 2013 – and two fellow former top Barclays bankers, Richard Boath and Roger Jenkins, were cleared in February 2020 over a £4 billion investment deal with Qatar in 2008, which helped the firm avoid a State rescue.

The Serious Fraud Office alleged that lucrative terms given to Qatar were hidden from the market and other investors through bogus advisory service agreements.

Mr Jenkins, Mr Kalaris and Mr Boath were acquitted by jurors following a five-month trial at the Old Bailey.