Britain’s biggest retirement provider scraps sale of SunLife

British savings giant Phoenix Group has shelved plans to sell historic over-50s brand SunLife after the City watchdog launched a review into its key insurance protection market.

The UK’s largest savings and retirement business said it had decided to “discontinue” the sale of SunLife, which started life in 1810, less than three months after unveiling plans to sell the group.

Andy Briggs, chief executive of Phoenix, blamed the “uncertainty” triggered by a Financial Conduct Authority (FCA) investigation into the protection insurance market after the watchdog raised concerns over whether products offered good value for money.

The decision comes after Phoenix in June revealed that it was exploring the potential sale of SunLife having received a “number of initial expressions of interest” from third-party buyers.

Phoenix at the time said that following a strategic review, SunLife was deemed “no longer core to the delivery of its vision of becoming the UK’s leading retirement savings and income business”.

However, the FTSE 100 company reversed course on Monday and described SunLife as a “valuable asset which contributes to the group’s new business growth”.

Phoenix bought the company from French insurance giant AXA eight years ago, and analysts at Deutsche Bank have estimated that the division could fetch £190m if it was sold.

Founded in London more than 200 years ago, SunLife has been one of the most recognisable names in finance for decades.

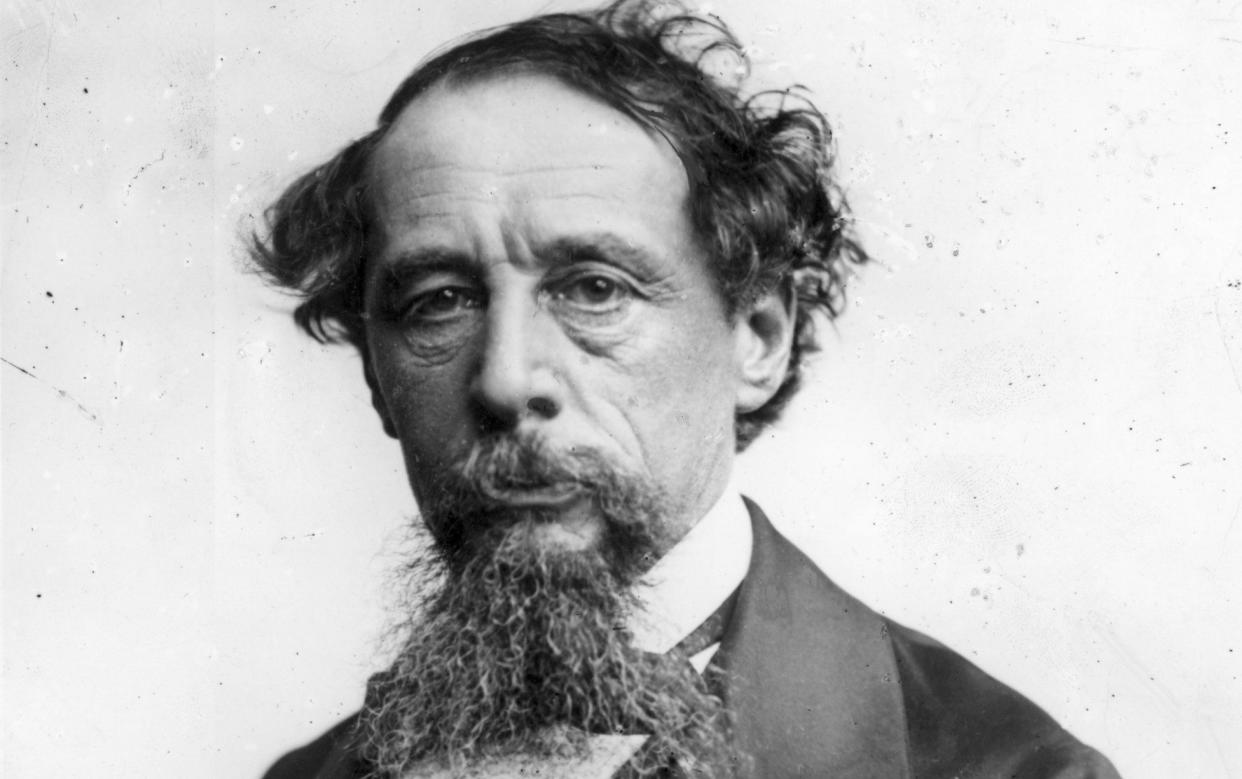

The group famously turned down novelist Charles Dickens as a client in 1841, refusing to sell him a life insurance policy owing to his health problems.

Today it focuses on products for people aged 50 and over such as life insurance and equity release.

The FCA announced a market study into pure protection insurance last month over concerns that consumers are being sold policies which provide “poor value”. This includes cases where the total insurance premiums paid over a lifetime are far more than the maximum payout policyholders would ever receive.

The review will particularly address conflict of interest concerns over the commission rates that insurers pay to intermediaries selling their products to customers.

The FCA warned that poorly designed commission arrangements could see firms incentivised to push products which did not match consumers’ needs.

The review is likely to focus on the sale of term assurance, critical illness cover, income protection insurance and whole of life insurance including policies for over-50s, according to Deutsche Bank.

Mr Briggs said that Phoenix’s plans to offload its distribution business via the SunLife sale created “a level of uncertainty for the interested parties in the markets”.

He told The Telegraph: “By keeping the business, we’re agnostic as to what the commission levels are because we’ve got both sides of the equation: manufacturing and distribution.

“So we concluded that a disposal wouldn’t maximise shareholder value.”

Pure protection insurance is designed to support individuals and their families with their finances if the policy holder dies or is unable to meet financial commitments. About £4bn in protection insurance claims were paid to policyholders in 2022, according to the FCA.

Mr Briggs also noted that SunLife, which recorded post-tax profit of £16m in 2023, was only a “very small part” of Phoenix.

It came as Phoenix posted a 15pc rise in underlying operating profits to £360m in the first half of 2024, boosted by pensions and savings business. Phoenix’s share price fell more than 4pc after the announcement.