Cigarette maker sells British inhaler business after backlash

Marlboro cigarette maker Philip Morris has been forced to sell a British maker of asthma inhalers at a steep loss after a growing backlash from health groups opposed to its ownership.

Philip Morris International (PMI) bought Vectura Group three years ago as part of a plan to transform itself into a “broader healthcare and wellness” group but now says the shift has been derailed by “unwarranted opposition”.

Vectura makes treatments for respiratory illnesses caused by smoking, among other products. PMI’s ownership has prompted criticism from campaigners outraged that a cigarette maker could benefit from the treatment of smoking-related diseases.

The company had faced medical boycotts, including being barred from a major medical conference shortly after the takeover after other speakers threatened to withdraw unless Vectura pulled out.

Jacek Olczak, chief executive officer of PMI, on Tuesday said the sale would free Vectura from the “unreasonable burden of external constraints and criticism related to our ownership”.

PMI will suffer a steep loss on the deal after paying £1.1bn for Vectura.

The US company will sell the division to Molex, part of an US oil and chemicals conglomerate run by the billionaire Charles Koch, for an initial £150m plus potential payments of £148m.

PMI had already taken a $680m (£516bn) impairment against the unit and abandoned its growth plans.

The Marlboro owner’s controversial takeover of London listed Vectura came after the inhaler manufacturer’s board had already recommended a bid by private equity firm Carlyle.

At the time, PMI hinted at the short-termism of private equity owners, saying: “PMI’s business model and strategy is driven by a long-term commitment to the transformation of its business and not a search for short term gains and efficiency.”

But long-term ownership was seemingly not to be.

The deal quickly incurred the fury of anti-smoking activists.

When PMI’s bid was first announced in 2021, Mr Olczak claimed campaigners were “settling old scores” against the tobacco industry.

He claimed that health charities were “not interested in progress” and were seeking to prevent the company moving away from cigarette sales.

In July, the charity Asthma + Lung UK urged patients to tell doctors they did not want inhalers made by a tobacco company.

Sarah MacFadyen, the charity’s head of policy, said: “Addictive tobacco products cause and exacerbate lung disease, so Philip Morris’s takeover of Vectura has been widely condemned.

“If people feel uncomfortable using an inhaler brand linked to the tobacco industry, they should speak to their healthcare professional about trying an alternative device. For most people, there are a range of alternatives that are just as effective and safe.”

Deborah Arnott, chief executive of Action on Smoking and Health, on Tuesday said: “Philip Morris seems to believe that owning a pharmaceutical company combined with incessant repetition of its smoke-free mantra entitles it to a free pass but it doesn’t.”

Philip Morris International shares dropped 2.8pc this afternoon.

Read the latest updates below.

07:03 PM BST

Signing off...

Thanks for joining us today. We will be back in the morning with the latest from the markets, but you can catch up with our business stories in the meantime here.

06:18 PM BST

Taylor Swift’s record label sees higher profit, helped by superfans

Universal Music Group has said that it expects profits to be boosted over the next few years as a result of higher subscription revenue and more partnerships, boosted by the superfans of its artists such as Taylor Swift, BTS and Drake.

At an event for investors held today at London’s Abbey Road Studios, the world’s biggest music label spelled out its plans to revive slowing subscriber and streaming growth.

Sir Lucien Grainge, the chief executive, said streaming was entering a new era that would rely on monetising superfandom, focusing not only on subscriber growth, but also on average revenue per user.

Sir Lucien told investors:

Valuable as streaming is, it has also levelled the playing field ... the deeply passionate listener pays the same price for the same access as the casual one.

He said the company was targetting superfans through physical collectibles, premium merchandise as well as live and digital events.

In outlook given today, the record company said it sees annual subscription revenue growth of 8-10pc through to 2028, higher than the analyst consensus of 6.6pc. It said it expects annual core profit growth of more than 10pc during the period.

Shares rose as much as 4.5pc during the day but closed 1pc lower.

06:01 PM BST

Wall Street pushes downwards

Wall Street has changed direction this evening, with the S&P 500 and Dow Jones Industrial Average now both down about 0.1pc.

The S&P 500 had earlier risen by 0.7pc while the Dow had risen by 0.5pc

The Nasdaq has also given up almost all of its earlier gains of 1.1pc and is now up around 0.1pc.

05:26 PM BST

Global stocks rise as investors hopeful of US rate cut

Global stock markets have been moving higher today as investors await the US’s interest rate decision with bated breath.

London’s FTSE 100 made steady gains, helped by B&Q owner Kingfisher soaring by more than a tenth.

The blue-chip index was up by 0.4pc, while the mid-cap FTSE 250 rose 0.1pc. US and European indexes are also up.

Financial markets are expecting America’s Federal Reserve to reduce interest rates on Wednesday. It would be the central bank’s first rate cut since 2020.

James Knightley, chief international economist for ING, said the outcome is likely to be a “coin toss”, with some members of its rate-setting committee less certain that monetary policy should be eased. He said:

An economy growing at 2.5pc to 3pc with low unemployment, inflation above target and equities at all-time highs suggests there will be large pockets of resistance, which makes the outcome tomorrow a coin toss.

05:22 PM BST

S&P 500 hits record high

Wall Street’s main stock indexes rose on Tuesday, with the S&P 500 hitting an record high ahead of a crucial Federal Reserve interest-rate decision.

The benchmark index touched 5,670.81 after rising 0.7pc during the afternoon, erasing the last of a deep selloff that lasted through late July and early August, sparked by an unexpected spike in unemployment.

A new reoirt from the US Commerce Department shows that retail sales rose unexpectedly in August, after a decline in car dealership receipts was offset by strength in online purchases. The figures suggestthe economy was on solid footing through most of the third quarter of the year.

Microsoft gave one of the biggest boosts to the S&P 500, with as much as a 2.4pc rise after the AI-frontrunner’s board approved a new $60bn share buyback program and hiked its quarterly dividend by 10pc.

05:18 PM BST

European stocks rise on retail sales and rate cut expectations

European stocks rose today, lifted by better than expected retail sales figures out of the US and by the anticipation of a hefty interest rate cut from the Federal Reserve.

All the main indexes ended the session higher in Europe.

The pan-European Stoxx 600, which includes some of Britain’s biggest companies, rose 0.4pc. France’s Cac 40 rose 0.5pc, while Germany’s Dax closed up a similar amount.

05:07 PM BST

FTSE closes up

The FTSE 100 closed up 0.4pc. B&Q owner Kingfisher was the top riser, up 11.2pc, followed by easyJet, up 6.2pc.

The biggest faller was BAE Systems, down 4.7pc, followed by British American Tobacco, down 2.4pc.

04:28 PM BST

US stocks and the dollar rise with eyes on the Fed

Wall Street followed UK and European peers higher this afternoon, while the dollar also rose.

It come after unexpectedly strong economic data from Washington curbed slowdown fears a day before an expected interest rate cut by the Federal Reserve.

Data on Tuesday showed US retail sales rose in August and production at factories rebounded.

“That points to a healthy state of the economy,” said Peter Cardillo, chief market economist at Spartan Capital Securities. Mr Cardillo expects Fed chair Jerome Powell to cut rates by a quarter percentage point on Wednesday, and would be looking for clues to future moves.

“He might hint the Fed could be more aggressive in the coming meetings ... I think they start off being cautious,” he said.

The S&P 500 rose to an all-time high during trading and is on track for a record close. It is currently up 0.4pc.

The Dow Jones Industrial Average is also up 0.4pc, while the Nasdaq is up 0.7pc.

Eddie Kennedy, of Marlborough Investment Management, said:

Everyone’s pricing in the soft landing and it feels like the Fed have been quite transparent that we’re in a rate cutting environment.

Generally stocks have done well post those sort of environments.

04:11 PM BST

Intel stock surges on plans to make AI chips for Amazon and separate out foundry

Shares of Intel have surged 6.8pc after the chipmaker said its foundry business would make some custom artificial intelligence chips for Amazon Web Services.

Chief executive Pat Gelsinger told employees that Intel will create an AI fabric chip for Amazon’s cloud services division at its foundry business, a struggling division that he said would become a separate subsidiary of Intel.

Mr Gelsinger said:

A subsidiary structure will unlock important benefits. It provides our external foundry customers and suppliers with clearer separation and independence from the rest of Intel.

Importantly, it also gives us future flexibility to evaluate independent sources of funding and optimise the capital structure of each business to maximise growth and shareholder value creation.

Harlan Sur of JP Morgan believes that making the foundry business a subsidiary is a logical next step.

“We believe this move is a natural progression to drive better transparency and decision making/efficiencies and therefore should not be viewed as a surprise,” the analyst said.

Mr Sur anticipates the shift could possibly lead to a spin out of the business over the next few years.

03:59 PM BST

Oil prices rise on interest rate hopes

The price of a barrel of oil is rising amid hopes that an interest rate cut this week in the US will boost demand.

Axel Rudolph, senior technical analyst at online trading platform IG, said:

The near 8pc recovery rally in the crude oil price from last week’s 16-month low [comes as research] shows that traders are the least bullish oil in over a decade ...

[America’s West Texas Intermediate grade of crude oil] is trading back around the $70 per barrel mark as Brent crude oil flirts with the $73 level.

The price of crude has been hit by worries over the resilience of China’s economy and signs of overproduction.

03:53 PM BST

US Fed begins two-day meeting set to end with rate cut

The US Federal Reserve began a two-day interest rate discussion at 3:30pm today that is all but certain to end with its first cut since March 2020, as inflation continues to ease.

The Fed’s rate decision will be announced tomorrow evening.

Policymakers are widely expected to debate whether to choose a small cut of a quarter of a percentage point, or to make an aggressive half point reduction to the Fed’s benchmark lending rate.

The Fed goes into the meeting in an enviable position, with US inflation easing towards its long-term target of two percent, and a resilient-yet-cooling labour market.

The data raises hopes that the Fed can achieve the rare feat of bringing inflation back down to target without triggering a recession - known as a “soft landing”.

While a larger, half a percentage point cut would do more to push down the cost of borrowing, it also runs the risk of reigniting inflation - and Fed policymakers are unlikely to support it, according to KPMG chief economist Diane Swonk. She said:

A larger, one-half percent cut will no doubt be discussed during the meeting, but Fed Chairman Jay Powell is unlikely to have the votes to get a half percent cut in September over the finish line.

Either way, we still expect to see a full one percent of cuts prior to year-end, which means at least one outsized cut in September, November or December.

The futures markets price in a probability of around 65 percent that the Fed will announce a half point cut on Wednesday, according to data from CME Group.

03:33 PM BST

THG considers spinning off tech platform

Cult Beauty and Myprotein operator THG has said it is considering spinning off its technology platform in the hope of restoring its share price, while it also reported slower sales this year.

The Manchester-based business runs a system called Ingenuity which works closely with warehouses to manage online sales.

It is used by brands including Holland & Barrett and L’Oreal, as well as THG’s brands which also include Lookfantastic and Dermstore.

But THG said it was in talks to demerge Ingenuity, which would leave it with its two consumer divisions, beauty and nutrition.

This would take place at the same time as a planned restructuring of how its shares are listed on the London Stock Exchange (LSE).

The company said it had consulted extensively with shareholders and decided it would be in their best interests. It would also increase its chances of being included in London’s FTSE index, the company said.

THG’s share price was down 10pc today, having already come under pressure in recent years and has dropped by more than 90pc since it first floated on the LSE in 2020.

With that I will head off, and leave you in the hands of Alex Singleton.

03:23 PM BST

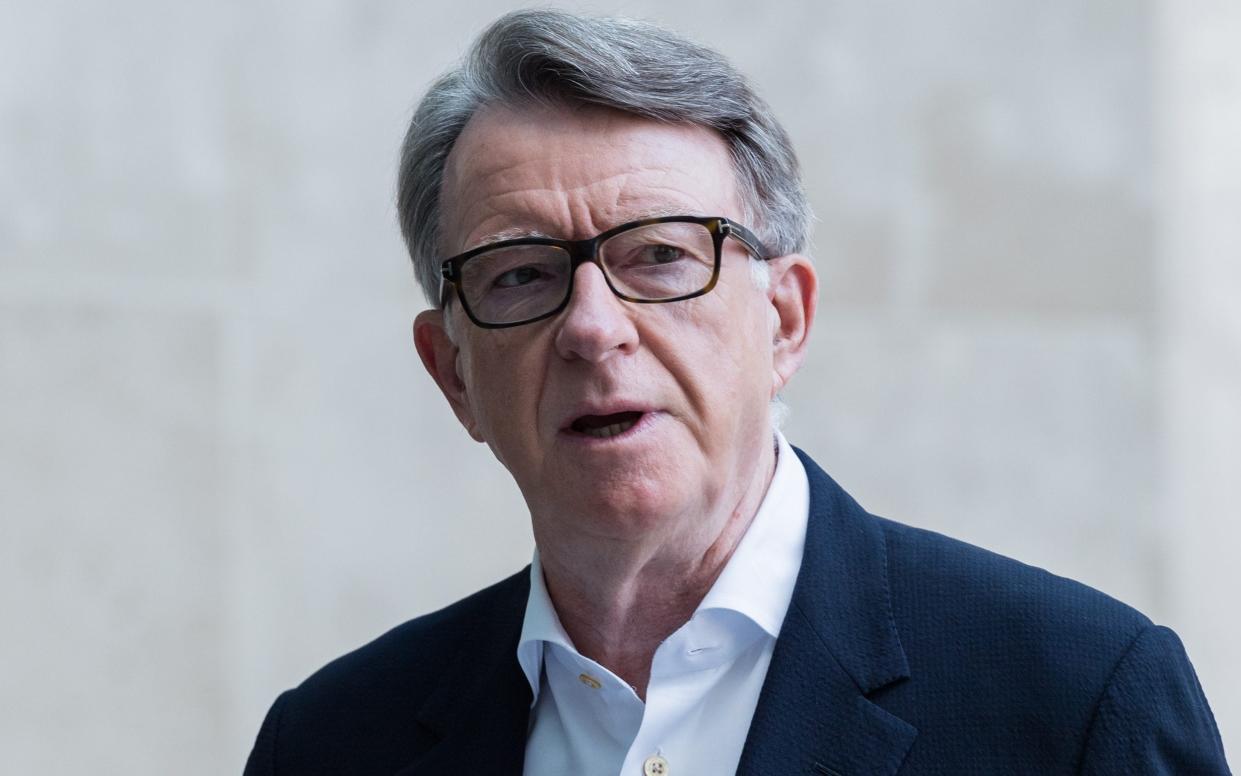

Starmer won’t boycott China like Tories, says Lord Mandelson

Lord Mandelson has suggested Sir Keir Starmer will improve relations with China following the deterioration of diplomacy between London and Beijing under Conservative governments.

The Labour party grandee, who is a close adviser to the Prime Minister, said the Government would maintain “proper channels of communication” with China.

Britain’s relations with China soured sharply since former prime minister David Cameron proclaimed a “golden era” of relations with Beijing in 2015.

Speaking during his first trip to Hong Kong in more than four years, Lord Mandelson said:

It was in danger of operating a boycott of Hong Kong and the necessary communication that Britain needs to maintain with China.

And that’s what is going to change under the new government.

03:04 PM BST

Virgin Galactic shares drop as customer launches years away

Sir Richard Branson’s space tourism company Virgin Galactic suffered a sharp fall in its share price after analysts raised concerns about the length of time it will take for it to take customers into space.

Shares dropped as much as 7.5pc as Morgan Stanley slashed its price target from $35 to $5 as it warned that company will not operate revenue-generating flights until 2026.

Earlier this year, Virgin Galactic was scrambling to save its US listing after its share price fell below the minimum required under stock exchange rules.

On Wednesday night it said it had received a notice from the New York Stock Exchange that its shares had traded at an average price below $1 – the Wall Street minimum – for 30 days, putting it in potential breach of listing rules.

The company’s shares are currently trading at $6.59.

Virgin Galactic was founded in 2004 and went public in 2019. Two years later, Sir Richard fulfilled a decades-long dream by travelling to the edge of space.

The company was worth as much as $14bn (£11bn) during a market boom in 2021, but its value now sits at around $184m after a series of setbacks to its plans to take paying members of the public to space.

02:53 PM BST

Tesco could use Clubcard data to alert shoppers to health content of their groceries

Tesco could use Clubcard data to warn shoppers when they are buying too many unhealthy items, its chief executive has said.

Our retail editor Hannah Boland has the latest:

The boss of Britain’s biggest supermarket said he expected to use artificial intelligence (AI) to monitor how customers were shopping to help “nudge” people into making healthier choices.

Tesco’s Ken Murphy said: “I can see it nudging you, saying: ‘look, I’ve noticed over time that in your shopping basket your sodium salt content is 250pc of your daily recommended allowance. I would recommend you substitute this, this and this for lower sodium products to improve your heart health’.”

He said this was “very simple stuff” which could “really improve people’s daily lives”.

Read how it has put health and privacy campaigners at loggerheads.

02:36 PM BST

US stocks rise as American consumers hold strong

Wall Street indexes rose at the opening bell as the latest retail sales figures showed US consumers were holding up better than expected.

The Dow Jones Industrial Average rose 0.3pc to 41,745.33, while the broad-based S&P 500 gained 0.4pc to 5,654.07.

The tech-heavy Nasdaq Composite was up 0.6pc to 17,705.03 after the opening bell.

02:22 PM BST

BBC World Service must be ‘funded outside licence fee’, says Davie

Tim Davie, the director general of the BBC, has said the BBC World Service “needs to be funded outside the licence fee”.

Speaking at the Royal Television Society (RTS) London Conference, Mr Davie said the corporation would still continue to fund the World Service “at the level it’s at”.

He said: “I’ll be very clear that the World Service needs to be funded outside the licence fee.”

Mr Davie was then asked how it would be funded instead, to which he replied: “We will continue to support the World Service at the level it’s at, which you know the Government put in £104m as well. So you’re nearly at £300m, that is enough to (be) just holding on.

“My view is, if you look what China’s investing, Russia, £6bn to £8bn now. Voice of America does a good job about £900m.

“I think the Government and all of us, have a real choice around soft power and the UK mojo abroad.”

02:13 PM BST

Smaller rate cut on the way as US consumers remain strong, say economists

The US Federal Reserve will cut interest rates by a quarter of a percentage point as data shows US consumer spending remains resilient, according to economists.

US retail sales in August performed better than expected, falling from 1.1pc to 0.1pc, compared to forecasts of a drop to minus 0.2pc.

Olivia Cross, North America economist at Capital Economics, saidL

The stronger than expected retail sales data for August suggest that, boosted by rapid wealth gains and falling energy prices, consumers continue to spend freely despite the labour market slowdown.

With control group sales maintaining strong upward momentum, our forecast points to an acceleration in consumption growth in the third quarter.

Although it will be a close call, and financial markets are still pricing in around a 65pc chance of a 50bp interest rate cut from the Fed tomorrow, we still think that the broader data are more consistent with a 25bp step.

RSM’s chief US economist agrees:

US Retail Sales: if one was hoping for the August sales report to tip the Fed rate decision it won't. I still think 25bps is the correct call given sticky service sector.

— Joseph Brusuelas (@joebrusuelas) September 17, 2024

01:59 PM BST

Canada’s inflation falls to 2pc

Canada’s annual inflation rate reached the central bank’s target in August for the first time since February 2021 as it cooled to 2pc.

Analysts had forecast the consumer price index (CPI) would cool to 2.1pc from 2.5pc in July.

The Canadian dollar weakened on the news, dipping 0.2pc to C$1.1361 against the US dollar, or 73.45 cents.

The easing of price pressures was primarily helped by a drop in prices of petrol, telephone services and clothing and footwear.

At the Bank of Canada’s monetary policy decision announcement earlier this month Governor Tiff Macklem said the bank had to increasingly guard against the risk that inflation could fall below its target as economic growth was weak.

The Bank has reduced its key policy rate three times in a row from June, cutting by a cumulative 75 basis point to 4.25pc.

Canada Inflation Ratehttps://t.co/Y8PG5HrQKC pic.twitter.com/jXnUfsmWAI

— TRADING ECONOMICS (@tEconomics) September 17, 2024

01:39 PM BST

Wall Street poised to rise after better-than-expected US retail sales

US stock indexes extended gains after a higher-than-expected rise in monthly retail sales indicated a healthy consumer, allaying fears about a sharp slowdown in the American economy.

Retail sales for August rose 0.1pc compared to an estimate of a 0.2pc decrease, according to economists.

They had increased by an upwardly revised 1.1pc in the previous month.

In premarket trading, the Dow Jones Industrial Average was up 127 points, or 0.3pc, the Nasdaq gained 119.75 points, or 0.6pc, and the S&P 500 was up 23.75 points, or 0.4pc.

US Retail Sales (Aug) print +0.1% m/m vs.-0.2% eyed.

Core Retail Sales missed at +0.1% m/m vs.+0.2% anticipated.$DXY ticks toward daily highs at 100.75 pic.twitter.com/Kqezwy526a— Matt Weller CFA, CMT (@MWellerFX) September 17, 2024

01:25 PM BST

Lammy announces £908m climate finance for Asian Development Bank

Britain will next month provide a guarantee for the Asian Development Bank (ADB) to help unlock $1.2bn (£908m) of climate finance for developing countries, Foreign Secretary David Lammy has said.

Wealthy nations have a commitment to provide $100bn each year in climate finance to developing countries to help them cope with climate change.

The Cop29 UN climate summit in November is tasked with agreeing a new funding target.

Earlier this month the ADB said it had approved a new goal to devote 50pc of its annual lending to climate finance by 2030 and boost financing of private sector projects as part of a strategy update for the rest of the decade.

In a speech at Kew Gardens, Mr Lammy said:

I’m determined to restore Britain’s reputation for commitment and innovation in the world of development finance.

This starts with the multilateral development banks.

That’s why next month, I will lay before parliament a UK guarantee for the Asian Development Bank, which will unlock $1.2bn in climate finance from the bank for developing countries in the region.

Mr Lammy said that, subject to reforms, Britain also supported a capital increase for the International Bank for Reconstruction and Development as a key source of climate finance.

01:14 PM BST

Telegraph readers: Everything Labour has done is anti-growth

Labour “don’t know how to make growth happen”, Telegraph readers have said, as the Energy Secretary has vowed to take on nimbys to increase investment in renewable power.

Here is a selection of some of your fellow readers’ views, as the Prime Minister also insisted the Budget would not stifle growth.

12:59 PM BST

US tech giant halts €30bn factory in latest blow to German economy

Intel has halted plans for a €30bn (£25bn) microchip facility in Germany in a major blow to Europe’s technology plans.

Our technology editor James Titcomb has the details:

The US chipmaking giant said it would delay construction at a site in Magdeburg by around two years, as well as postponing a facility in Poland, despite receiving billions of euros in state subsidies.

The announcement came as the Silicon Valley icon unveiled a radical overhaul aimed at reversing a share price collapse, fuelled by concerns that Intel has lost its ability to make cutting-edge chips.

Intel chief executive Pat Gelsinger told investors that it would separate its manufacturing arm from the rest of the business, signalling a possible future break-up of the company.

It has now sparked a row among members of Germany’s coalition government.

12:35 PM BST

Guardian in talks to sell The Observer

The Guardian Media Group (GMG) is in talks to sell The Observer to a startup founded by a former BBC News director.

Our reporter Adam Mawardi has the latest:

GMG is in negotiations to sell the world’s oldest Sunday paper to Tortoise Media run by James Harding, Sky News first reported.

The announcement came as The Guardian revealed that it burned through tens of millions of pounds in cash as the newspaper grapples with an advertising slump.

The left-leaning newspaper on Tuesday announced that its cash outflow hit £36.5m in 2023/24, a 73pc increase on the previous year.

The organisation said the increased cash burn reflects its planned investment into its US operation and European edition of the newspaper to increase its international reach.

It also cited planned spending on technology and product investment, including the launch of The Guardian’s new cooking app.

The Guardian’s overall revenue sank 2.5pc to £257.8m which the organisation blamed on a slowdown in the advertising market and “sustained structural pressures on print”.

However, the newspaper grew its online reader revenue 8pc to £88.2m, more than half of which comes outside of the UK.

12:30 PM BST

Britain needs ‘hardheaded, realist approach’ to climate crisis, says Lammy

The UK must use “all levers at our disposal” to tackle the climate crisis, David Lammy said, as he outlined the Government’s plan to create a global clean power alliance.

Speaking from Kew Gardens, the Foreign Secretary said: “Time and time again, it is the most vulnerable who bear the brunt of the crisis.”

He added: “So our goal is progressive, a liveable planet for all now and in the future, but we need a hardheaded, realist approach towards using all levers at our disposal, from the diplomatic to the financial.

“And I say to you now, these are not contradictions, because nothing could be more central for the UK’s national interests than delivering global progress on arresting rising temperatures.”

Mr Lammy went on to say: “The threat may not feel as urgent as a terrorist or an imperialist autocrat, but it is more fundamental, it is systemic, it’s pervasive and accelerating towards us at pace.”

12:18 PM BST

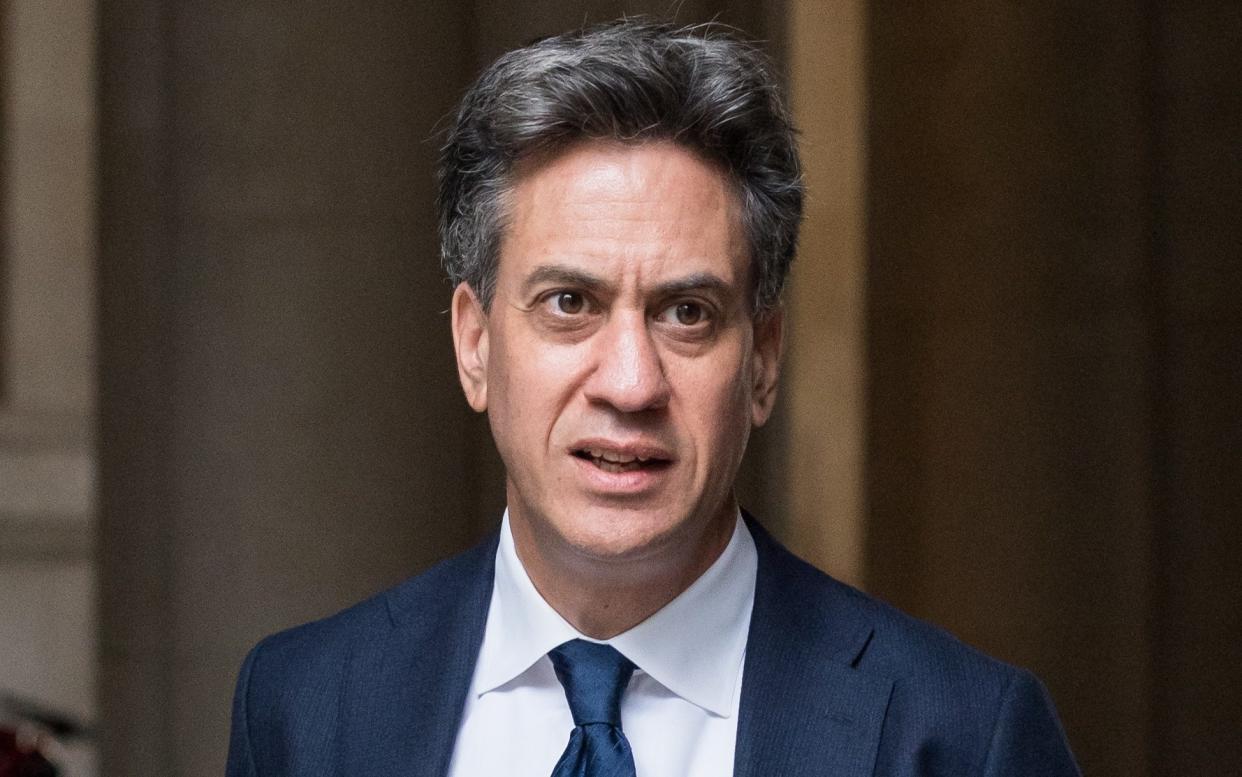

Miliband speech follows ‘smash the nimbys’ event

Ed Miliband spoke to energy industry figures as his Labour colleagues launched a pressure group that aims to “smash nimbys”.

Chief Secretary to the Treasury Darren Jones and the Prime Minister’s Special Adviser Varun Chandra helped launch the alliance of more than 100 executives from energy, construction and infrastructure businesses.

The Labour Infrastructure Forum’s director Gerry McFall said:

Good quality infrastructure is essential to delivering economic growth.

The Labour Infrastructure Forum is committed to supporting the Government by developing evidence-based policy recommendations around Labour’s manifesto commitments and legislative agenda to get the country building again and improve delivery.

The Government’s first year is a critical time to lay down a marker for the rest of the parliament.

Before it is captured by ‘events’, it must make meaningful progress on its mandate to take on the nimbys and rebuild our country - from transport to water, energy to housing.

12:11 PM BST

Miliband dangles sweeteners to nimbys who allow wind farm expansion

Ed Miliband has opened the door to offering sweeteners to communities who open the door to wind and solar expansion in their areas.

The Energy Secretary said “community benefit” is a part of the Government’s push to increasing renewable power production.

“We’re saying to people ‘we do need to build this infrastructure, if you host this clean energy infrastructure there should be a benefit to your community from doing so’.

“That is a fair deal to make with people.”

The Energy Secretary said the Government has “got to take the decisions” to expand wind and solar energy across Britain.

He told the Energy UK conference in London:

It is all very well government going out and explaining why it needs to happen - absolutely we should do that - but then we’ve got to make it happen and that requires difficult decisions.

I have made four decisions on solar since I came to office - some of them had been hanging around for a year under the previous government.

11:48 AM BST

Miliband vows to take on communities blocking wind farm expansion

Ed Miliband has vowed to take on communities blocking the expansion of wind and solar energy in the name of improving Britain’s “energy security and affordability”.

The Energy Secretary told the Energy UK conference in London:

Every wind turbine we block, every solar farm we reject, every piece of grid we fail to build makes us less secure and more exposed.

Previous governments have ducked, dithered and delayed these difficult decisions. And here’s the thing, it’s the poorest in our society who have paid the price.

My message today is that we will take on the blockers, the delayers, the obstructionists.

Because clean energy is the economic justice, energy security and national security fight of our time.

That’s why one of the prime minister’s five driving missions is to make Britain a clean energy superpower, delivering clean power by 2030 and accelerating to net zero across the economy.

11:26 AM BST

Hope for German recovery ‘visibly fading’

German investor confidence fell significantly more than expected in September, a survey showed, as a hoped-for recovery in Europe’s largest economy failed to materialise.

The ZEW institute’s closely watched economic expectations index fell to 3.6 points, down sharply from 19.2 points a month earlier.

Analysts surveyed by financial data firm FactSet had predicted a much smaller decline to 16.6 points.

The September drop comes after the indicator dropped 22.6 points in August, its worst decline in two years.

ZEW president Achim Wambach said: “The hope for a swift improvement in the economic situation is visibly fading.”

The fall was driven by lower economic expectations for the eurozone as a whole, but particularly for Germany, Mr Wambach said.

11:00 AM BST

Energy crisis isn’t over, says Miliband

Ed Miliband has warned the energy crisis is not over as he outlined the case for moving Britain away from fossil fuels.

The Energy Secretary said the drive to clean energy “is right, not just on grounds of climate... but also energy security and affordability”.

During a speech at the Energy UK conference in London, he said British-based renewable energy is the “cheapest and fastest way to reduce vulnerability to global fossil fuel markets”.

“The lesson for this Government is we must build a new era of energy independence on a foundation of clean energy,” he said, adding:.

It is our view, as a Government, that no country should experience a crisis of this scale and with such devastating effects and carry on as before.

The central lesson of the crisis for Britain is we paid a heavy price because of our exposure to fossil fuels.

Yes, Britain has made progress on the roll out of renewables but we still depend on gas to generate more than a third of our electricity and to heat more than four out of five of our homes.

He added that the Government needed to be persistent in its policy as “uncertainty is the enemy of investment”.

10:06 AM BST

Treasury must stop ‘saying no to everything’ to boost growth, says Burnham

Rachel Reeves has been urged by a senior Labour politician to stop “saying no to everything” to boost Britain’s infrastructure in next month’s Budget.

Greater Manchester mayor Andy Burnham said the Treasury must change the way it thinks if it is to boost economic growth.

He flagged upcoming decisions on transport infrastructure outside London and the South East as a key test of the Government’s ambitions.

He told the Financial Times:

There are a number of ‘growth tests’ looming — not least on rail infrastructure — and we will find out soon whether the Treasury is able to transform itself into the growth department.

It needs to understand that growth comes from giving hope and planting seeds, rather than saying no to everything.

09:49 AM BST

Gas prices edge up from seven-week low

Wholesale gas prices have inched upwards after hitting a seven-week low as demand remains weak ahead of the winter.

Dutch front-month futures, the European benchmark, rose as much as 1.8pc at remain around €34 per megawatt hour after dropping 4.4pc on Monday to the lowest level since late July.

It comes as the continent heads towards the winter months with ample stockpiles.

09:26 AM BST

Pound steadies ahead of Fed rate decision

The pound was little changed against the dollar as investors wait to see if the US Federal Reserve announces a jumbo interest rate cut this week.

Sterling was flat at $1.321 after advancing 0.6pc on Monday amid increased bets that policymakers will reduce borrowing costs by half a percentage point (50 basis points), rather than the quarter of a point previously expected (25 basis points).

Mohit Kumar, chief Europe economist at Jefferies, said:

We would argue that a ‘safer’ approach for [Fed chairman Jerome] Powell would be to cut by 25bp, but keep the door side open for a 50bp cut at later meetings. Proximity of elections also imply that it would be a more politically neutral stance.

However, the number of articles supporting a 50bp cut and comments from ex Fed officials seem to make a 50bp easing a more accepted approach.

Market is currently pricing in 42bp of cuts for the Fed. If after the retail sales number today we move to pricing in 45bp or more from the Fed, it would make it difficult for Powell to surprise the markets and there is a possibility that Powell could be blamed for doing too little, too late.

UK inflation data, also due out tomorrow, will also be closely watched for more indications on the future path of interest rates in Britain.

The Bank of England is expected to hold interest rates at 5pc at its meeting on Thursday.

09:04 AM BST

Pret customers switch to filter coffee

Pret A Manger has revealed more customers are switching to 99p filter coffee as it revealed its annual revenues hit £1.1bn last year.

The sandwich chain said filter coffee sales increased by 60pc in August compared to June after it announced the return of the 99p price in July.

It comes as global sales rose 22pc in 2023 to £1.1bn, although it has not yet published its full-year profit figure.

Bosses said £1 in every £4 at Pret comes from outside the UK as it pushes its international expansion and new franchise partnerships.

Chief executive Pano Christou said: “Looking to the future, our recipe for success is to focus on doing what Pret does best: creating delicious, freshly made food for our customers, only using the high-quality ingredients that we’re proud to have in our kitchens.”

08:49 AM BST

FTSE 100 rises ahead of big interest rate decisions

The FTSE 100 rose to a two-week high amid increasing bets of a larger US interest rate cut and strength in domestic retail shares after an improved forecast from Kingfisher.

The blue-chip index rose 0.8pc to its highest since September 3. The pound eased slightly, relieving some pressure on the index’s export-oriented companies, while the midcao FTSE 250 was up 0.3pc.

Home improvement retailer Kingfisher led FTSE 100 gains after raising the bottom-end of its profit outlook for the full year.

With all eyes on the Federal Reserve’s expected first interest rate cut on Wednesday, traders lifted the chances of a larger-than-usual 50-basis-point reduction to 67pc from 50pc on Monday, as per the CME’s FedWatch tool.

The Bank of England also meets this week. Analysts largely expect policymakers to leave rates on hold, so investors will primarily watch for clues on the Bank’s path for the rest of the year and updates on the pace of its bond sales.

Among individual movers, shares of gambling technology company Playtech fell 2.9pc after the company said it will sell its Italian unit Snaitech for €2.3bn (£1.9bn) to Flutter Entertainment. Flutter’s US shares were up 1.3pc in premarket trading.

Shares of Essentra slumped as much as 24.6pc after the plastic and metal components supplier warned that annual operating profit could miss market expectations due to weaker conditions in Europe and slower recovery in the Americas.

Shares of e-commerce company THG slipped as much as 4.9pc after it said it was actively looking to demerge its technology services arm.

08:26 AM BST

B&Q owner hails ‘early signs of housing market recovery’

B&Q owner Kingfisher said raised the lower end of its profit target for the year as its boss said it had experienced “positive early signs of a housing market recovery”, particularly in the UK.

Shares rose 7.5pc in early trading as it said Britons are “continuing to repair, maintain and renovate their existing homes” despite revealing a slight decline in sales.

The company, which is also behind Screwfix, said sales dipped 2.4pc on a constant currency basis to £6.8bn in the six months to the end of July.

However, pre-tax profits edged up 2.3pc to £324m and it predicted it would make annual earnings of between £510m to £550m, up from previous guidance of £490m to £550m.

Chief executive Thierry Garnier said:

Trading overall in the first half was in line with our expectations. This was underpinned by customers continuing to repair, maintain and renovate their existing homes, driving resilient volume trends in our core product categories.

As expected, demand for ‘big-ticket’ categories has remained weak, in line with the broader market, while seasonal category sales trends have improved since early July.

Against this backdrop we maintained a strong focus on effectively managing our costs and inventory.

08:04 AM BST

UK stocks jump ahead of potential jumbo US rate cuts

The FTSE 100 began the day strongly with just a day to go before the expected start of the Federal Reserve’s interest rate cuts that could see policymakers deliver an outsized reduction in borrowing costs.

The UK’s blue-chip stock index rose 0.8pc to 8,342.66 after the open, while the midcap FTSE 250 gained 0.5pc to 20,999.25.

07:52 AM BST

Ovo to pay £2.4m for failing to address complaints

Energy supplier Ovo has agreed to pay a £2.4m penalty for failures over how it handled customer complaints, regulator Ofgem has announced.

The watchdog said that 1,395 Ovo customers will receive compensation after they were affected by lengthy delays in seeing their complaints addressed - in some cases up to 18 months.

It said there were also delays in Ovo actioning the Energy Ombudsman’s decision when complaints were progressed.

Ovo will pay £378,512 in compensation to affected customers and has also paid an extra £2m to the Energy Industry Voluntary Redress Scheme “in recognition of the severity of consumer detriment caused”, according to Ofgem.

It comes after it emerged millionaire Stephen Fitzpatrick charged Ovo Energy £43m last year amid growing scrutiny over his sprawling empire’s finances.

Ofgem deputy director of retail compliance Jacqui Gehrmann said:

Energy is an essential service. When things go wrong, it can cause consumers a lot of distress.

In this case Ovo failed to adequately protect and respond to their customers when it was needed most. This is not acceptable.

07:42 AM BST

Financial markets will suffer ‘withdrawal symptoms’ as interest rates fall, economists warn

Savers must brace for more crashes in financial markets as top central bankers said that last month’s rollercoaster was evidence of the pain of “withdrawal symptoms” from years of ultra-low interest rates.

Our deputy economics editor Tim Wallace has the details:

Claudio Borio at the Bank for International Settlements, known as the central bank for central bankers, said traders in markets are exhibiting “hypersensitivity” to and bad news, which challenges the justification of high share prices.

He said it means more episodes of “turbulence” are likely to be on the way.

“We should be under no illusion: this is not the first and will not be the last turbulence in markets,” he said.

“It is part of a bigger picture: the inevitable withdrawal symptoms that markets suffer as they transition away from the extraordinary period of exceptionally low interest rates and ample liquidity that has prevailed for so long.”

In the crunch of late July and early August, shares on the tech-heavy Nasdaq drop by more than 14pc from the peak to the trough, sparking fears of a recession and emergency rate cuts from the Federal Reserve. Tech stocks are considered to be particularly sensitive as they are very highly valued.

Markets had already begun to slide before the Federal Reserve held rates at 5.5pc at the end of July. This decision was followed by several sets of weak economic data in the US, raising fears that the central bank had failed to appreciate the extent of the economy’s slowdown.

07:29 AM BST

Flutter to buy Italian gambling giant for £1.9bn

Betting giant Flutter Entertainment has agreed to buy Snaitech, the Italian subsidiary of UK-listed Playtech, for €2.3bn (£1.9bn).

Flutter, which owns Paddy Power, said that the deal is expected to close in the second quarter of next year.

Snaitech, which trades under the name Snai, is one of the biggest betting brands in Italy, and enjoyed 5pc revenue growth in the last financial year to €946.6m.

Peter Jackson, chief executive of Flutter, said:

This transaction is compelling strategically and financially.

It fits perfectly within our strategy for value creating M&A and creates a significant opportunity to accelerate Snai’s growth by providing them with access to Flutter’s market leading products and capabilities both in the US and globally.

07:27 AM BST

Budget will not include any policies that stifle growth, says Starmer

Rachel Reeves’ first budget will not include any policies that harm economic growth, Sir Keir Starmer has declared.

The Prime Minister said the number one priority in the Chancellor’s speech next month would be “economic growth and wealth creation”.

However, he insisted he would not put off dealing with the £22bn “black hole” in the public finances identified by Ms Reeves.

On his trip to Italy, the Sir Keir said: “I’m well aware that I’ll be judged in five years’ time on whether I’ve delivered the change I’ve promised to the country in relation to the economy, living standards, the health service, public services and whether people feel better off.

“So we’re going to do the tough, difficult things up front. But everything is guided by the principle: economic growth and wealth creation is the number one priority.”

He added it is “important to borrow to invest” but hinted the Government would not try to do this by adjusting the fiscal rules that require debt to be falling within five years.

He said: “We’ve just passed legislation to make sure that we never ever get to the situation that Liz Truss got us into before.

“What I’ve said to my team is Liz Truss had unfunded commitments for tax cuts.

“Unfunded commitments for spending are just as bad and likely to have the impact on the economy, which is why the stability piece applies just as much to a Labour government as it does to a Tory government in my view.”

07:25 AM BST

Good morning

Thanks for joining me. Sir Keir Starmer insisted the Budget will not stifled economic growth despite the Chancellor’s pledge to deal with a £22bn “black hole” in the public finances.

The Prime Minister added that he supports borrowing to invest but said the Government has “got to make sure we have strong fiscal rules in place”.

5 things to start your day

1) Airbus revives plans for UK helicopter factory | Aerospace giant unveils sweetened proposal in attempt to win £1bn defence contract

2) BP to launch $2bn sale of onshore wind business amid green energy retreat | Oil giant to concentrate efforts on solar power after investor revolt

3) Rolls-Royce calls on Covid vaccine chief to drive mini-nuke rollout | Supply chain veteran Ruth Todd joins efforts to develop first commercially viable SMRs

4) ‘Disease and bankruptcy beckon’ under Labour as Britain’s worklessness crisis deepens | Sir Keir Starmer issued stark warning over impact of long-term sickness and soaring benefits bill

5) Ben Wright: Reeves is being encouraged to target a backbone of the British economy | Calls to reform inheritance tax relief could only have been dreamed up by those with little understanding of how the real world works

What happened overnight

Asian stocks gained on Tuesday, with extended holidays in China and South Korea making for thin trading conditions.

The stronger yen stoked concerns about Japanese exporters’ earnings and pulled down Tokyo’s Nikkei by 2pc to 35,828.54 as the market returned from a national holiday on Monday.

The Hang Seng in Hong Kong advanced 1.4pc to 17,661.70. Markets in mainland China and South Korea were closed.

Australia’s S&P/ASX 200 gained 0.3pc to 8,143.00.

On Wall Street, the Dow Jones rose 0.6pc, to close at 41,622.08, the S&P 500 gained 0.1pc, to 5,633.09, and the Nasdaq Composite index dropped 0.5pc, to 17,592.13.

The yield on benchmark US 10-year Treasury notes dropped to 3.62pc, from 3.65pc late on Friday.