How pensioners could be targeted in Reeves’s Budget

Pensioners are in the firing line of Rachel Reeves’ first Budget after Labour pledged not to raise taxes – but only for “working people”.

Removing winter fuel payments from 10 million retirees suggests the Chancellor is serious about whittling down pensioners’ wealth. But there could be more to come.

The Telegraph revealed in July that Ms Reeves is reviewing civil servant proposals to radically reform how tax relief applies to pension contributions.

Introducing a 30p flat rate would provide a massive windfall for the Treasury. It would also lead to people’s pension growth being severely stunted.

From bringing pensions within the scope of inheritance tax to means-testing the state pension, here are all the ways Labour could target Britain’s pensioners.

Winter fuel payments will be restricted

Rachel Reeves has already announced that she will scrap winter fuel payments for 10 million pensioners.

Currently, all 11.4 million pensioners receive an extra £200 to help heat their homes every winter, with people aged over 80 receiving a blanket £300 payment.

For those pensioners living in Britain, the payment will now be restricted to people claiming pension credit.

To qualify for pension credit, you must be above state pension age, which is currently 66.

Single pensioners are eligible to receive pension credit if they have a weekly income of up to £218, while those in a couple, where you are both above state pension age, must have an income of up to £332 per week.

But if you have a disability or you are a carer, you may still qualify for pension credit even if you have a higher income. To see whether you qualify, you can use the Government’s pension credit calculator.

Could Labour start means-testing the state pension?

One of the most radical reforms the party could consider is to “means-test” the state pension, so that wealthier retirees receive less of it, or are denied the benefit altogether.

Currently, everyone aged 66 and over is entitled to payments of £11,502 a year if they have paid National Insurance for 35 years.

Sir Edward Troup, one of four tax advisers appointed by Rachel Reeves, suggested last month that the state pension should be means-tested. But experts have warned that the policy would be “disastrous” for pensioners and undermine the financial bedrock of retirement.

If means-testing were introduced, the Government may choose to use a “clawback” mechanism, similar to the personal allowance taper, according to Mr McPhail.

The personal allowance of £12,570 is the amount someone can earn tax-free. But once your net income hits £100,000, the allowance tapers down at a rate of £1 for every £2 you earn, disappearing completely at £125,140.

He said: “With means-testing, you can set the dials wherever you like. If you’re a higher rate taxpayer in retirement, for instance, by definition you’re pretty well off.

“The Government could say that for every £2 above a threshold you lose £1 of state pension.

“So if you had an extra £23,000 of income above the threshold you could lose all of your state pension.”

Could Labour take aim at pensions tax relief – and how much would it cost you?

Pension savers currently receive tax relief on contributions at their marginal or highest rate of income tax. This gives everyone 20pc in relief, but higher rate taxpayers get 40pc and additional rate payers are entitled to 45pc.

Those on salaries between £50,271 and £125,140 currently receive 55pc of all tax relief paid out on pension contributions.

In 2016, then-backbencher Rachel Reeves, now Chancellor, penned a column for The Times arguing for a 33pc flat rate of tax relief. According to the latest HMRC figures, around 6.5 million people could lose out under such a system.

Labour has been forced to deny this is policy and it is no longer understood to be Ms Reeves’ view. However, the party has not definitively ruled it out and if it were introduced, it could hit some high earners with six-figure losses over a 30-year career.

According to Hargreaves Lansdown, a worker earning £100,000 and contributing 10pc of their salary into a pension would lose £700 a year. For someone earning £200,000, this rises to £2,400, while someone on £300,000 would lose £3,600.

What else does Labour have planned for our pension savings?

The Government is planning to introduce a Pensions Schemes Bill, which it said will deliver growth and better outcomes for more than 15 million people in private pension schemes. It also aims to “increase the amount available for pension savers” and could help the average earner boost their pot by more than £11,000.

A key part of the Bill is the automatic consolidation of small pension pots, which are created when workers move jobs. It will attempt to tackle the number of pension pots people have lost track of – which currently stands at 4.8 million.

The legislation will also introduce a standardised test for pension providers to demonstrate the value they’re delivering, along with a requirement to offer more retirement solutions to savers.

The Government estimates its changes could lead to a 9pc boost to the average pension pot over a worker’s career.

However, it remains unclear how people will avoid paying income tax on the state pension. It’s currently on course to become taxable by 2028, but no plans have been announced to match the key Conservative pledge of a higher tax-free personal allowance for the retired, known as the “triple lock plus”.

Labour’s lifetime allowance U-turn

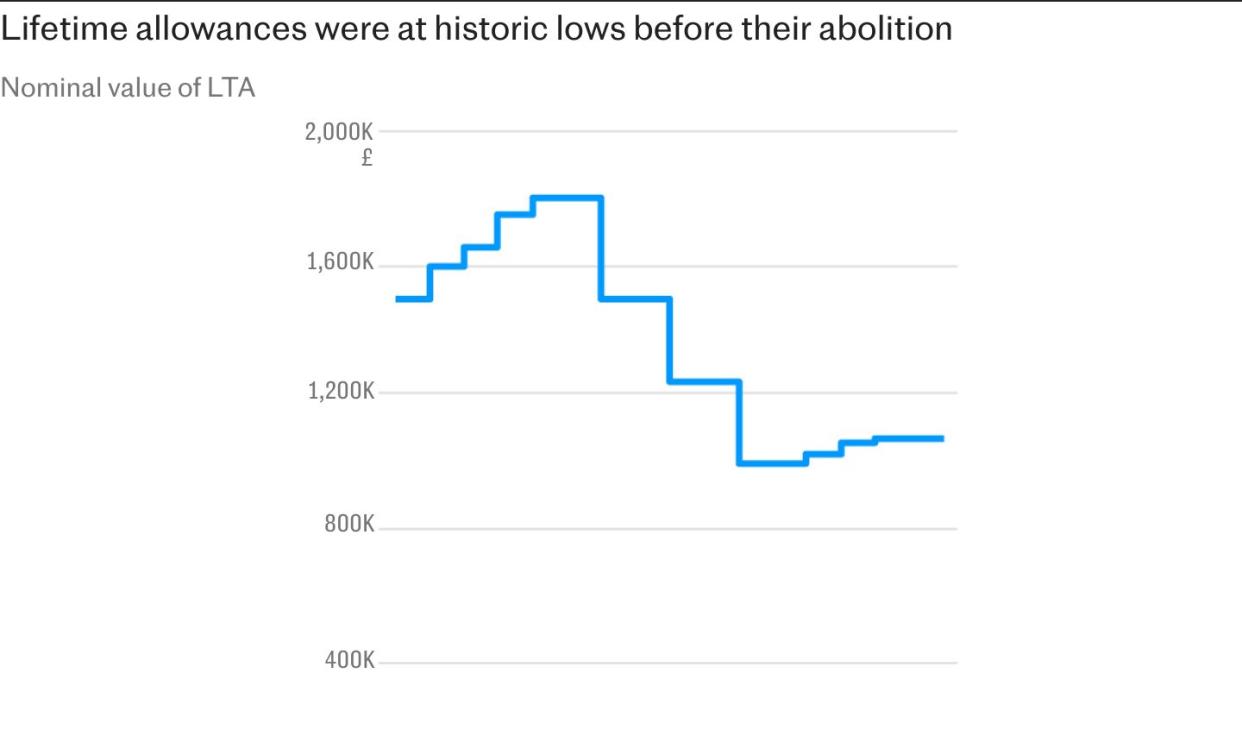

The lifetime allowance (LTA) was a tax charge on larger pensions. Once your pot exceeded £1,073,100, you paid 55pc on any amount above this level if you took cash as a lump sum. For funds accessed in other ways, it was 25pc on top of income tax.

The threshold has fluctuated between £1m and £1.8m since the LTA’s inception in 2006.

In the 2023 Budget, then-chancellor Jeremy Hunt announced the end of the LTA from April 2024. Labour immediately pledged to reintroduce it but shelved that plan when it became clear senior doctors and other public sector workers would be likely to leave the workforce as a result.

Three new pension allowances replaced the LTA when it was abolished. If Labour retains them, the maximum tax-free lump sum will be frozen at 25pc of your pension, or a maximum cash value of £268,275.

Now that there is no overall cap on how much you can save into a pension, only income tax is due beyond that. The same applies to pots you leave behind when you die and certain overseas transfers.

If Labour were to change their minds again and bring the charge back, it could affect up to 6pc of savers approaching retirement, or around 250,000 people, according to consultancy LCP.

Experts agree that any changes would take time to implement and would be unlikely to apply retrospectively to any actions taken now. However, the LTA is not mentioned in Labour’s manifesto and the party could still reintroduce it.

HMRC has already confirmed the LTA’s removal is not complete, with the legislation including a so-called “Henry VIII clause” that means it can be changed at a later date.

Until it is, some richer pension savers have been advised not to access their retirement benefits.

Could the ‘pension freedoms’ be reversed?

In 2015, then-chancellor George Osborne introduced the “pension freedom” reforms. The changes dramatically increased people’s options for accessing their pension flexibly, such as offering the opportunity to withdraw an entire pot in one go or enter a drawdown facility.

Some experts believe this is an area where Labour could seek changes.

Tom McPhail, of financial consultancy the Lang Cat, said the party could increase the minimum age for accessing your pension from 55 to 60. He also speculated that Labour could restrict your right to taking cash out before first securing a minimum amount of guaranteed long-term income.

Will Labour end the tax-free lump sum?

Labour has also been urged to slash the tax-free lump sum savers can withdraw. The Fabian Society, a leading left-wing think tank, suggested cutting the amount of money anyone aged 55 and over can take out of their retirement pots without paying tax from £268,275 to £100,000 – or 25pc of the total pot, whichever is lower.

The tax-free lump sum is considered one of the most generous and best understood tax breaks for pensioners.

Savers with a defined contribution pension can access 25pc of their pension pot as a tax-free lump sum, up to a maximum of £268,275, which can be taken in one go or across several withdrawals.

This allowance was frozen in 2020-21, meaning the real value of the lump sum is already diminishing each year with inflation.

Reducing the allowance to £100,000 would mean someone with a £1m pension who chooses to withdraw 25pc as a lump sum would have to pay an extra £45,000 in income tax, assuming they have no other income.

Is a pension ‘death duty’ on the cards?

Inheritance tax (IHT) is currently not charged on pensions and Labour has denied that a pension death tax is “party policy”.

But experts have warned that the party could be tempted to extend the scope of IHT to cover pension pots if it entered office. Mr McPhail said a death tax raid on pensions was a “real risk” under Labour.

Currently, if someone dies before the age of 75, any of their unused pension is inherited tax free. For anyone who dies after this age, income tax applies at the point the beneficiary withdraws the money.

Analysis shows that families inheriting a £100,000 pension – roughly the size of the average pension pot for a 55 to 64 year old – could be stung with a £65,000 tax bill if IHT was applied.

In recent years, pensions have become a far better vehicle for dodging death duties. Many savers have filled their pensions partly as a way to limit IHT which would otherwise be due if the money was left in a bank account or Isa.

What are Labour’s plans for pension fund investments?

The party’s manifesto stated that it would “act to increase investment from pension funds in UK markets”.

It is not yet clear whether pension funds will be forced or just encouraged to switch investments to domestic assets – or the percentage of assets that might be switched.

Labour may simply decide to introduce disclosure requirements around investment in British equities rather than making investments mandatory.

However, if restrictions were placed on investments, the growth potential of pension pots could fall given the poor performance of London-listed companies in recent years compared to American companies, for instance.

Neil Rayner, of investment platform True Potential, said that while Britain was in need of more investment from private business, plans to redirect funds’ assets based on geography “increased the risk and volatility for these portfolios, which could harm long-term results and make financial planning far more difficult for millions of people.”

Could auto-enrolment be expanded?

Labour has promised to carry out a wide-ranging “review of the pensions landscape”, which might lead to changes to minimum pension contribution rates.

Before “auto-enrolment” was introduced in 2012, many people were not saving enough for retirement and risked running out of money after they stopped working.

Now, the minimum contribution to a workplace pension is 8pc of your salary. This is made up of a 5pc contribution from the employee and a 3pc contribution from the employer.

However, industry insiders believe the rates still aren’t high enough to ensure a good standard of living in retirement and have lobbied for minimum contributions to rise. There are also calls for the self-employed to be brought into scope of the rules.

But continued cost of living pressures could make reforming auto-enrolment tricky for Labour, even if the political will is there.