‘We can’t downsize and want to escape Labour – so we’re moving 10,000 miles away’

Casie and Ian McDonald-Wood bought their dream home a decade ago with big plans for the property.

The couple, now in their 70s, converted the £300,000 agricultural barn on the border of Wiltshire and Hampshire into a luxury, eco-friendly home.

“It was our dream, something we always wanted to do,” says Mrs McDonald-Wood, 71.

But a combination of factors has left the couple considering their future plans.

Mrs McDonald-Wood says: “It is a fairly substantial property over 300 square metres. We bought it and converted it into a carbon negative building with solar panels, heat pumps – all of it.”

To fund the project, they used an interest-only mortgage of around £300,000 from lender Handlesbanken, with a plan to pay it off when it came to downsizing. Ten years later, it is clear their work has paid off and the property is now valued at around £1.6m.

But the property and surrounding three acres of land is more than just a home.

Having run their own strategy consulting business together, Ian and Casie weren’t ready to give up working full time and decided to turn the five-bedroom property into a bed and breakfast.

“We weren’t going to sit around trying to live on our state pension,” says Mrs McDonald-Wood. “We are still working because we don’t have a private pension and have always worked for ourselves. Running the B&B gives us the cash to do other things.”

Despite the success of the business, they decided in 2021 that it may be the right time to downsize, even with three golden retriever dogs. However, three years later, they are yet to find a buyer. The five offers they have had on the property have all fallen through.

And at the same time, they have struggled to find somewhere suitable to move to. The right size properties for them – one storey with a small garden – are hard to find and those that do exist come with a significant premium due to the demand.

The majority of sales in Wiltshire during the last year were detached properties, selling for an average price of £585,124, according to property website Rightmove.

“We have lots of friends all saying the same things. We like the size of the rooms we have; we just want fewer of them and a smaller garden.

“They are building new properties nearby in an estate but none are for retired people. They are all for families and if you are going to downsize in your 70s you want something that will last.”

There is also stamp duty to contend with. Mrs McDonald says that if they found a property for £950,000, they would be paying around £36,000 in land tax, even before additional costs such as estate agents and solicitors. Home buyers pay 10pc in tax on any value over £925,001 and 5pc on the value from £250,001 to £925,000.

The couple are not alone, millions of pensioners are stuck in homes that are too big because of the ‘downsizing’ penalty.

The wider economic picture hasn’t helped. As interest rates have risen, the couple say they chose to pay off the outstanding mortgage with an equity release loan with the option to draw down more as and when necessary.

“No matter how hard we worked we were never going to be able to afford the monthly payments,” says Mrs McDonald-Wood.

“I was wary of equity release because my parents had been caught out but the newer ones are a different kettle of fish. You are going to be racking up interest but on the other hand you are still able to live here and don’t have to go through the trauma of moving or downsizing.”

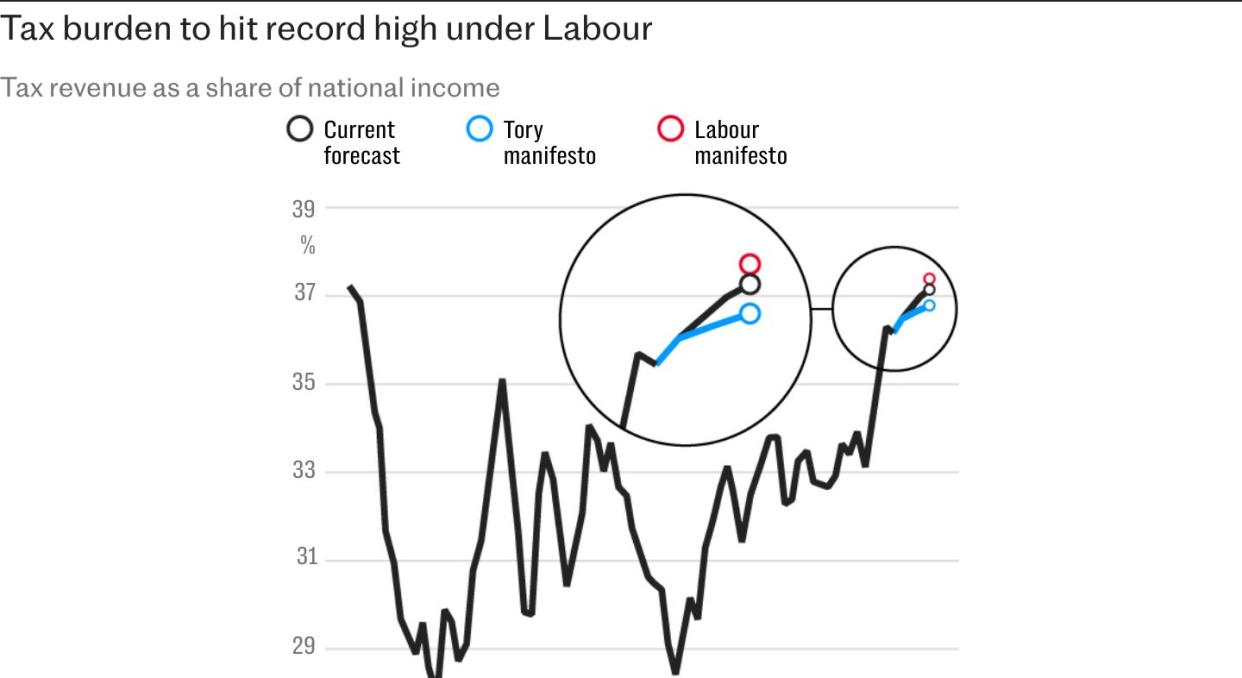

However, with Labour now in power they are worried future taxes will erode their equity and savings so have decided instead to get out.

They have two sons aged 37 and 34, one a doctor and one a restaurant manager, working in Australia and they now plan to join them, attracted by the better lifestyle and the hope of playing the important role of grandparents in the coming years.

“Like a lot of people our age most of our assets are tied up in our property, our pension is very little. We are aiming to go straight from here to Australia rather than buy somewhere else in the meantime.”

One tax they are concerned about is capital gains. Currently residential homes are not taxed in this way but second properties are and the Conservatives have accused Labour of planning to tax family homes in this way, a move that could net the treasury £31bn a year.

The couple are also concerned that if Labour go ahead with council tax reforms they will pay more each month, further biting into their retirement fund.

“It is an overall expectation that they are going to raid the baby boomers,” she says. “But it will take us a good two years to do it, sell it all up and get the dogs to Australia.”