Reeves urged to cut ‘extremely valuable’ public sector pensions

Rachel Reeves should cut public sector workers’ “extremely valuable” pensions at her maiden Budget, a leading think tank has said, amid continued pressure from unions over pay rises.

The Institute for Fiscal Studies (IFS) told the Chancellor that there is a “good case” for lowering pensions for public sector workers to fund future pay rises after the Government granted inflation-busting settlements to doctors, teachers and nurses.

The report published ahead of the Budget on Oct 30 warns that to overcome recruitment difficulties the Treasury must reform rather than just raise pay amid a surging wage bill.

It also noted the disparity between public sector and private sector pensions: “Public sector pensions remain extremely valuable relative to private sector comparators. The pension contributions from public sector employers are higher than those often seen for even high-earning private sector employees.”

The report comes weeks after the Treasury signed off £9bn in pay increases for millions of public sector workers, close to half the size of the £22bn “black hole” in the public finances which Ms Reeves claims was left by the Conservatives.

Sir Keir Starmer has pledged to “rebuild” Britain’s public services and “protect working people”.

But the IFS warned recruitment and retention issues loomed large across the public sector, highlighting prison officers, district judges and secondary school teachers as roles with the biggest challenges.

Unions have meanwhile signalled that this year’s pay settlements do not mean their job is done.

After accepting a 22pc pay rise for junior doctors, the British Medical Association warned Wes Streeting, the Health Secretary, that there was “a long way to go” adding that “he needs to be prepared for the consequences” if future deals disappoint.

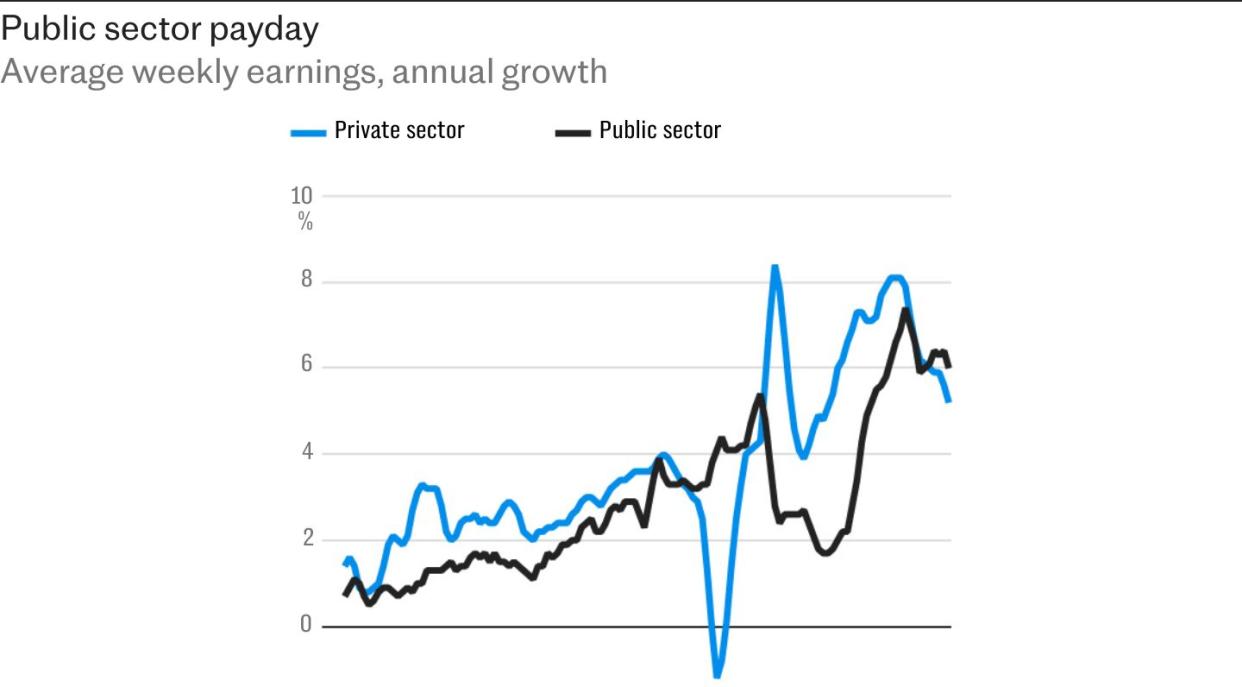

Closing the gap that has emerged between public and private sector pay rises since 2019 alone could result in a pay bill £17bn higher than today, according to the IFS.

Even uprating pay for public sector staff in line with earnings growth forecasts could land the Treasury with an annual bill of £6bn more.

Given such costs, the IFS said the Treasury should consider overhauling the entire pay system, targeting gold-plated pensions.

Andrew McKendrick, an author of the report, said: “Government needs to structure remuneration to make sure it is getting the right people in the right roles to help deliver public services. That might mean carefully rebalancing away from pensions and also towards higher-paid professions.”

Workers in the NHS receive an employer pension contribution of 23.7pc, police staff 35.3pc and those in the Armed Forces 43.8pc.

In contrast, an automatically enrolled worker in the private sector must contribute 8pc of their earnings that fall within £6,240 and £50,270.

Of the 8pc, only 3 percentage points must come from the employer.

This means an average earner on £35,000 would receive contributions equivalent to only 2.5pc of their total pay.

Higher minimum thresholds for employee contributions in the public sector than in the private also leave lower-paid staff struggling, the IFS warned.

Mr McKendrick said: “Public sector pensions remain far more valuable than those in the private sector, but significant numbers of lower-paid staff miss out as they cannot afford to make the required employee contributions.”

One in seven public sector workers earning between £10,000 and £16,000 a year are opting out of their pension scheme. This is more than twice the rate among those earning at least £31,000.

Higher-paid public sector workers and those based in London and the South East have seen the largest real-terms pay cuts, the IFS said.

This contributes to the difficulty of hiring for the highest paid public sector roles, according to the think tank.

Mr McKendrick said: “There continue to be big geographical differences in how well public sector pay compares with private sector pay. Gaps in pay between the two sectors are often bigger, and recruitment problems worse, for higher-paid groups such as judges and senior civil servants.”