Thames Water says bills must rise by more than £260 a year

Embattled Thames Water wants to raise customers’ bills by more than £260 a year, warning it will struggle to fund itself unless the inflation-busting increase is approved.

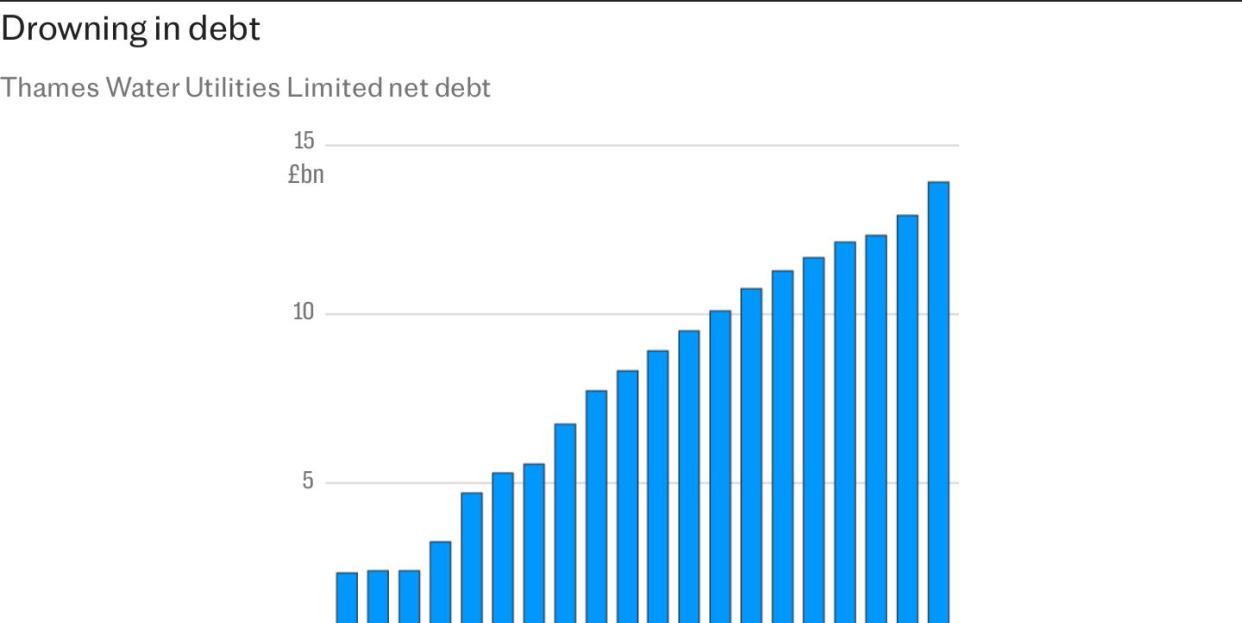

The debt-laden utility, which is the UK’s largest water company with 16m customers, has submitted fresh proposals to water watchdog Ofwat asking for permission to raise bills from £433 a year on average to £696 by 2030.

Proposals for the £263-a-year increase – equivalent to a 59pc rise – are higher than the previous suggestion of a 44pc increase put forward by Thames in April.

The company said the total had risen because of an expected reduction in customer numbers from its original plan, rather than plans to spend more on upgrades.

Under its revised plan, Thames said the average monthly customer bill would increase by £18.99 by the end of 2030.

The proposals are likely to prove contentious. Thames’s April plan was rejected by water regulator Ofwat as part of its draft determination process, as the watchdog said bill increases should be capped at 23pc.

Thames’s request is the latest salvo between the company and its regulator in a battle over how much the battered business will be allowed to increase prices.

Chairman Sir Adrian Montague said: “After decades of focusing on keeping bills low, now is the time for difficult choices.”

Thames has said it could not attract £3.3bn of new funds from shareholders to invest in the company if the regulator blocked its plan to increase bills. Thames risks running out of cash by next May if it cannot lure shareholders to invest.

Chief executive Chris Weston criticised Ofwat’s plans, saying: “On the basis of the draft determination given to us by Ofwat, both our own and independent analysis shows that our plan would be neither financeable nor investible and therefore not deliverable.

“It would also prevent the turnaround and recovery of the company.”

As part of the bill increase, Thames wants to invest £20.7bn to upgrade its creaking infrastructure. However, it hinges on whether Ofwat will allow shareholders to make an attractive rate of return on their investment.

Without fresh funding, Thames could fall under government control. The company has already been placed in a form of special measures as Ofwat appointed an independent monitor to keep an eye on the group’s performance.

Mr Weston said: “We want to deliver a considerable increase in investment in our infrastructure, with total expenditure of £20.7bn in our core plan and a further £3bn through gated mechanisms.

“The money we’re asking for from customers will be invested in new infrastructure and improving our services for the benefit of households and the environment. They are not being asked to pay twice but to make up for years of focus on keeping bills low.”

A water industry body warned on Wednesday that Ofwat’s plans to cap bill increases could create a “material risk” that suppliers may fail to raise enough cash to invest in stopping sewage leaks.

Trade association Water UK said Ofwat’s draft plans to limit the rise in household water bills to £19 a year on average would hold back firms’ abilities to improve services.

In a letter to David Black, Ofwat’s chief executive, the group warned that the bill cap would drive away the investors needed for a multibillion-pound plan to bring Britain’s water infrastructure up to scratch.

David Henderson, of Water UK, wrote: “Ofwat’s approach would make it impossible for the water sector to attract the level of investment that it needs and will reduce the UK’s attractiveness to international investment.”