Traders bet on jumbo US interest rate cut

Traders have increased bets that the US Federal Reserve will cut interest rates by half a percentage point next week in a move that could stimulate growth in the world economy.

US stock markets gained at the opening bell as money markets indicated there is more than a 50pc chance that policymakers will announce a jumbo sized rate cut.

Bond market yields fell - lowering the cost of government borrowing - after articles in the Financial Times and Wall Street Journal said Fed policymakers consider it “a close call” between a smaller quarter of a percentage point interest rate cut or a bigger move by half a percentage point.

Earlier this week, the chances of the Federal Open Market Committee (FOMC) cutting by half a percentage point - or 50 basis points - were as low as 14pc.

The Federal Reserve’s increased interest rates to a range of 5.25pc to 5.5pc in July last year - the highest level since 2001 - as it battled to bring down inflation, which fell to 2.5pc in August.

Bryan Whalen, chief investment officer at The TCW Group, said: “If the Fed cuts by 25 basis points next week, they are putting themselves behind the curve.”

Bob Savage, head of markets strategy and insights at BNY Mellon, added: “Markets want the FOMC to ease fast and get on with the risk of recession fighting.”

05:58 PM BST

Have a good weekend!

That’s all from us! We’ll be back again on Monday morning with the latest.

I’ll leave you with the latest story from Jonathan Leake, the Telegraph’s energy editor: Miliband takes control of Britain’s electricity network in £630m deal

05:47 PM BST

White House urges Boeing to reach deal with striking factory workers

The White House has urged Boeing to negotiate in “good faith” with the trade union representing 30,000 striking factory workers.

It comes after members of International Association of Machinists and Aerospace Workers (IAM) who produce Boeing’s top selling 737 MAX and other jets voted to strike on Thursday.

The members rejected the planemaker’s proposed deal, which included a $3,000 signing bonus and a pledge to build Boeing’s next commercial jet in the Seattle area.

A prolonged strike would weigh on airlines that depend on Boeing jets and suppliers that manufacture parts.

Boeing has said that it is ready to return to negotiations, indicating that it could sweeten the deal.

A White House spokesman said: “We encourage them to negotiate in good faith — toward an agreement that gives employees the benefits they deserve and makes the company stronger.”

05:16 PM BST

FTSE 100 closes the week in the green

The FTSE 100 has closed 0.39pc higher at 8,273.09, meaning it has grown by nearly 2pc in the past week.

Meanwhile, the midcap FTSE 250 index has finished up 0.96pc at 20,895.37.

04:34 PM BST

The Sun announces plans to ‘resize’ US operation

The Sun newspaper is planning to cut jobs across its US operations in response to ‘seismic change’ in the media landscape.

It is understood that overhaul will strengthen the tabloid’s video journalism as part of its editorial offering.

The move comes four years after The Sun launched in the US to target an American audience.

A spokesman for News UK, Rupert Murdoch’s media group which owns The Sun, said:

“The US Sun has been an incredibly successful business, driving billions of page views, however the digital landscape has experienced seismic change in the last 12 months and we need to reset the strategy and resize the team to secure the long term, sustainable future for The Sun’s business in the US.”

04:04 PM BST

Gold surges to another record high

The price of gold has risen to another record high as the dollar continues to decline ahead of a widely expected Federal Reserve rate cut next week.

Bullion climbed as much as 0.4pc to $2,568.06 an ounce on Friday, putting the precious metal on track for a weekly gain of almost 3pc.

It comes after the price of gold surged almost 2pc to a record high on Thursday after the euro pushed higher against the dollar as investors pared bets that the European Central Bank would cut interest rates again next month.

03:32 PM BST

UK markets rise amid rate cut hopes

The FTSE 100 has moved higher as traders increase bets on heftier cuts to interest rates in the US.

The UK’s blue chip index has risen 0.5pc today while the midcap FTSE 250 has gained 1pc.

Both indexes are on course for weekly gains.

With that I will duck out and wish you a good weekend when you get to it. Adam Mawardi will keep sending live updates on the markets until the end of the day.

03:16 PM BST

Zuckerberg secures greenlight to train AI on British Facebook posts in break with EU

Mark Zuckerberg’s Meta has been given the greenlight by Britain’s privacy watchdog to use millions of Britons’ Facebook and Instagram data to supercharge its artificial intelligence (AI) technology in a break with the EU.

Our senior technology reporter Matthew Field has the details:

In a decision likely to trigger a backlash from privacy advocates, the Information Commissioner’s Office (ICO) has waved through plans from Meta, the owner of Facebook and Instagram, to harvest billions of public posts and images from UK citizens.

The move will represent a divergence from Meta’s treatment in Brussels and comes amid mounting concern in Europe that the bloc’s byzantine technology regulations risk holding back growth and threatening domestic AI companies.

While Meta has already launched its AI bots in the US, it has delayed its plans for the UK and the EU amid concerns from regulators.

Read how approving the move represents a major break with EU policy by the UK.

03:04 PM BST

Pound edges higher amid bets on bigger US rate cuts

The pound has benefited from the renewed bets that the US Federal Reserve will cut interest rates by half a percentage point next week.

Sterling was up 0.2pc to $1.315. It is little changed against the euro, which is worth 84.4p.

02:39 PM BST

Boeing shares drop as workers go on strike

Boeing shares fell 2.2pc as trading began on Wall Street after workers at the plane manufacturer voted to go on strike.

The aerospace giant said it is “committed” to holding more talks after union members rejected a 25pc pay rise over four years.

02:33 PM BST

Wall Street rises as traders ramp up bets on half-point Fed rate cut

US stock markets gained at the opening bell as traders increased bets that the US Federal Reserve will cut interest rates by half a percentage point next week.

The Dow Jones Industrial Average rose 0.3pc to 41,226.84 as money markets indicated there is more than a 50pc chance that policymakers will announce a jumbo sized rate cut.

The S&P 500 gained 0.2pc to 5,607.68 while the tech-heavy Nasdaq Composite lifted 0.1pc to 17,588.75.

02:17 PM BST

Pink Floyd close to selling back catalogue for £400m despite band’s bitter feud

Pink Floyd are closing in on a $500m (£380m) deal to sell its music rights to Sony despite a bitter feud between the rock band’s members.

Our reporter James Warrington has the latest:

The legendary rockers, who burst on to London’s psychedelic scene in the 1960s, first began discussions to sell the rights to their vast catalogue of songs in 2022 to cash in on the booming market for song rights.

The catalogue, which includes hits such as Another Brick in the Wall and Money, attracted interest from several potential buyers including rival record labels Warner Music and BMG and music rights firm Hipgnosis.

But the talks stalled amid a bitter dispute between band members, in particular guitarist David Gilmour and bassist Roger Waters who have since forged successful solo careers.

01:48 PM BST

Worcester Bosch considers job cuts as consumers under pressure

Boiler maker Worcester Bosch is considering job cuts as customers put off home improvements.

The company, which employed about 1,800 staff as of 2022, blamed its restructuring plans on higher interest rates and a “move to electrification”.

Headquartered in Worcester, it was founded in 1962 and became part of the Bosch group in 1996.

A spokesman said:

The UK boiler market is showing significant volume reductions for the second year running as a result of factors such as the cost-of-living crisis, high interest rates and inflation along with the reduction in house building and a move to electrification.

It is essential that Worcester Bosch adapts to these market conditions, we have therefore taken the difficult decision to implement a re-organisation exercise across the business which would see changes to working practices and arrangements, regrettably some redundancies may form part of the exercise.

We will begin the consultation period shortly and will be supporting all staff impacted throughout that period. We have over 100 trained mental health champions available to support, as well as an employee assistance programme and a health and wellbeing team available for any of our staff.

01:24 PM BST

Mortgage rates finally fall for first-time buyers

First-time buyers and those with smaller deposits are finally feeling the impact of mortgage rate reductions as competition heats up between lenders.

Our senior money writer Fran Ivens has the latest:

Nationwide and Clydesdale now both offer rates close to 5pc for those buying a home with a 5pc deposit.

Clydesdale is offering a 5.02pc five-year fix for the group with a £999 fee, while Nationwide’s is 5.04pc following rate cuts of 0.25pc by the lender.

Similarly, TSB has cut its rate by up to 0.35pc, NatWest by up to 0.19pc and HSBC by up to 0.15pc.

Read where the cheapest deals can be found on the market.

01:05 PM BST

Gas prices rise after Egypt deal

Gas prices have risen after a big deal in Egypt showed global competiton for the fuel remains strong.

Dutch front-month futures, the benchmark contract for Europe, rose as much as 2.8pc after state-owned Egyptian General Petroleum bought 20 cargoes due to be delivered in the final three months of the year.

It indicates that Europe will have to compete for liquefied natural gas with Asia and Egypt.

However, stockpiles remain 93pc full, keeping prices in check.

While the European contract tipped above €36 per megawatt hour, the UK equivalent gained as much as 2.9pc to nearly 87p per therm.

12:58 PM BST

Press regulator announces five-year funding deal

The press regulator has announced a new funding settlement which protects its funding in real terms for the next five years.

The Independent Press Standards Organisation (Ipso) is financed by the Regulatory Funding Company, which is funded by member publications through subscription payments.

Ipso, which is marking 10 years as the UK’s independent regulator of newspapers, magazines and digital news, said the five-year settlement also allows it to call on additional resource if needed for exceptional costs.

It has also reached an agreement with regulated publishers to amend its regulations, giving it greater discretion to allocate resources to the most important complaints.

This will be achieved by reducing the burden of dealing with complaints that do not identify a potential breach of the Editors’ Code, Ipso said.

Lord Faulks KC, Ipso’s chairman, said:

Ten years from its foundation, regulation by Ipso is a clear mark of accountable journalism that distinguishes publishers committed to accountability and transparency from unregulated online content.

We are delighted to celebrate this milestone, working with our partners - including the public, industry, government and others - to protect the public and freedom of expression by promoting high standards.

12:38 PM BST

Wall Street poised for gains amid rate cut hopes

US stock indexes edged higher in premarket trading amid reports that the Federal Reserve is still considering a larger interest rate cut next week.

Traders’ bets now indicate there is a 44pc chance of a half a percentage point reduction next week, compared with 14pc seen on Thursday.

Deutsche Bank analysts said:

If pricing stays where it is currently, it would be the first meeting in years where there’s serious uncertainty about the rates decision.

A couple of articles were published in the Wall Street Journal and the Financial Times suggesting that a 50 bps move was still in play, which has led markets to once again re-evaluate their expectations.

Meanwhile, Boeing fell 3.9pc in premarket trading as its US West Coast factory workers voted to go on strike from today after overwhelmingly rejecting a contract deal.

In premarket trading, the Dow Jones Industrial Average and S&P 500 were up about 0.2pc and the Nasdaq 100 was 0.1pc higher.

12:03 PM BST

Russia raises interest rates as inflation grips Putin’s war economy

Russia’s central bank unexpectedly raised its interest rates and warned that further monetary tightening was needed to reduce inflation in Vladimir Putin’s war economy.

The Bank of Russia had been expected to leave interest rates on hold at 18pc but unexpectedly raised them to 19pc after data on Thursday howed inflation was still high.

Consumer price rises slowed to 9.05pc in August, only slightly down from 9.13pc the previous month.

The central bank said:

Overall, the inflation expectations of economic agents remain at elevated levels.

This reinforces the inertia of persistent inflation.

The latest set of macroeconomic forecasts saw inflation at 7.3pc for the full year, well above the regulator’s 4pc target.

The central bank said earlier that inflation had peaked in July and would gradually fall towards the end of the year.

11:55 AM BST

Plans for Britain’s first coal mine in 30 years scrapped after landmark legal defeat

Approval for Britain’s first coal mine in 30 years has been quashed by the High Court in a landmark victory for climate campaigners.

Our energy editor Jonathan Leake has the latest:

In a ruling published today, Mr Justice Holgate said that a decision by the Conservative government in 2022 to rubber-stamp the Cumbria coal mine in Whitehaven was “legally flawed”.

The judgement comes after a legal challenge from Friends of the Earth and South Lakes Action on Climate Change, who successfully argued that the planning permission did not take into account the impact of burning coal on the environment.

Mr Justice Holgate said: “The assumption that the proposed mine would not produce a net increase in greenhouse gas emissions or would be a net zero mine is legally flawed.”

It is the latest blow for proposed energy plants in Britain.

11:47 AM BST

Nigel Farage could be banned from hosting GB News show under new plans

Nigel Farage could be banned from hosting his GB News show under new plans being drawn up by MPs.

Our reporter James Warrington has the details:

Lucy Powell, a Cabinet minister and chairman of the newly-formed Commons Modernisation Committee, has tasked officials with looking into politicians’ media appearances as part of a wider effort to improve standards.

The Government has already launched a crackdown on second jobs by banning MPs from providing paid advice on policy or how Parliament works.

But it has stopped short of clamping down on media roles despite growing controversy over the use of sitting MPs as news presenters, particularly on GB News.

Read what Mr Farage is paid for his work as a presenter for the start-up broadcaster.

11:28 AM BST

Oil prices rise amid hopes for bigger US rate cuts

Oil prices have risen after a hurricane in the US disrupted crude production and the value of the dollar dropped.

Brent crude rose 1pc towards $73 a barrel, advancing for a third session and pushing its weekly climb to more than 2pc.

It comes as Hurricane Francine shutdown production at several sites in the Gulf of Mexico.

Prices were also boosted by the falling value of the dollar after reports that it is a “close call” between the US Federal Reserve cutting interest rates by a quarter of a percentage point or a larger half a percentage point.

Crude remains 16pc lower this quarter amid concerns about demand from China.

The International Energy Agency said that global consumption growth in the first half was the lowest since the pandemic.

11:08 AM BST

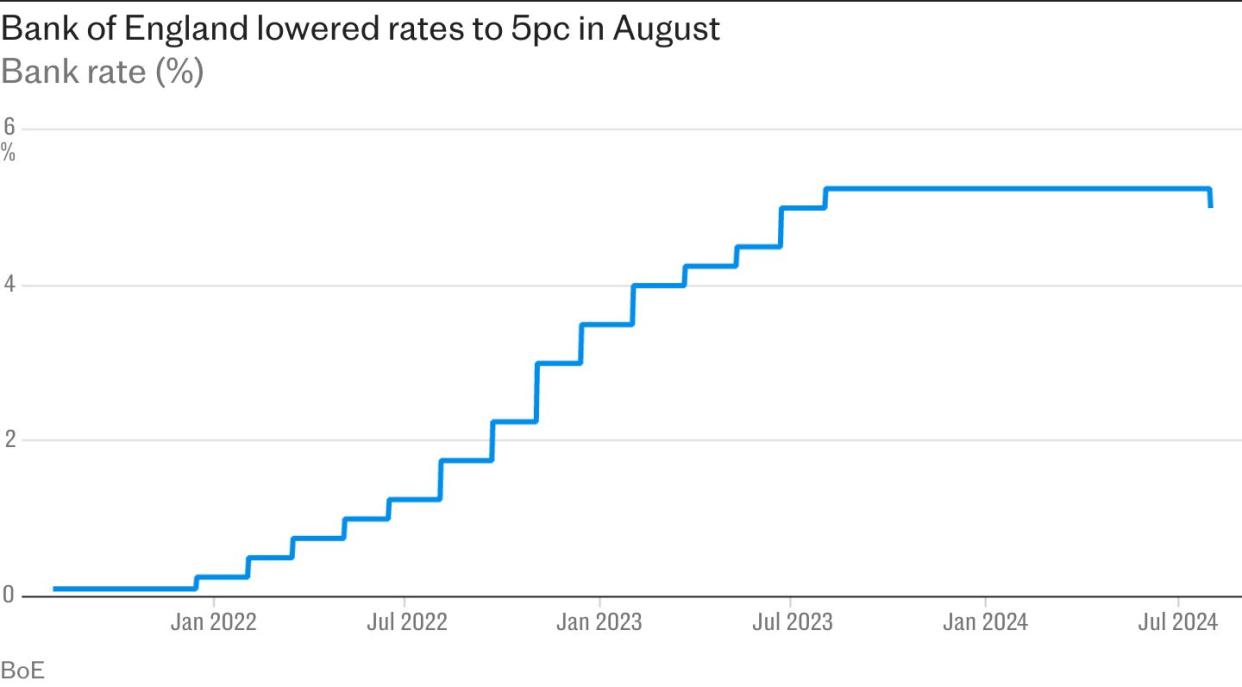

Interest rates to fall to 3pc within a year, says Wall Street bank

Households grappling with soaring mortgages have been given hope by a Wall Street bank, after it predicted the Bank of England will cut interest rates at a much faster pace than markets anticipate.

Goldman Sachs said policymakers will begin reducing borrowing costs from November and will then cut rates at every meeting until the Bank Rate hits 3pc in September next year.

The Bank of England raised interest rates to 5.25pc in August last year - its highest level since 2008 - as it battled to bring down inflation which surged to a peak of 11.1pc in October 2022.

However, inflation has fallen back to 2.2pc, in line with the Bank’s 2pc target, and Goldman said there are “compelling reasons” why rate setters on the Monetary Policy Committee will increase the pace of cuts, which began with a drop to 5pc last month.

Money markets traders are betting that the Bank will reduce rates to about 3.5pc by August next year.

However, Goldman said that wage growth “will cool meaningfully in coming months”, which will help lower services inflation, which has long been a source of worry for the Bank.

It expects services inflation to decelerate to 5pc by the end of the year, which is 0.3 percentage points below the Bank of England’s August forecast, before falling to 3.8pc by the end of 2025.

Goldman Sachs said policymakers would also likely pick up the pace of rate cuts as other central banks around the world reduce borrowing costs more quickly.

Analyst Sven Jari Stehn said: “A continued quarterly pace through 2025 would make the Bank of England a significant outlier relative to other advanced economies, which is historically unusual.”

10:51 AM BST

Households expect interest rates to fall

The British public expect interest rates to fall, a Bank of England survey shows, marking the first time the nation has widely expected borrowing costs to fall since the global financial crisis.

The quarterly Inflation Attitudes Survey found 38oc of respondents expect rates to come down in the next 12 months while 29pc anticipate a rise.

It was the first time that the public has on balance expected borrowing costs to ease since November 2008, when Britain was and the world was in the depths of the global financial crisis.

10:34 AM BST

Public satisfaction in Bank of England improves

The public’s confidence in the Bank of England to bring down inflation turned positive for the first time in two years, a month after policymakers began cutting interest rates.

The Bank’s latest inflation attitudes survey found that its approval rating reached 4pc last month, compared to minus 4pc in May.

It was the Bank’s first positive figure since February 2022, when inflation had risen to 6.2pc.

10:15 AM BST

Pound rises amid speculation on interest rate cuts

The pound has jumped against the dollar amid renewed speculation that the US Federal Reserve could opt for a jumbo interest rate cut next week after all.

Sterling was up 0.1pc versus the dollar to $1.314 following a 0.7pc gain on Thursday.

It rallied after articles in the Financial Times and Wall Street Journal said Fed policymakers consider it “a close call” between a smaller quarter of a percentage point interest rate cut or a bigger move by half a percentage point.

As a result, traders raised the chances of a half-point cut from the Fed next week to 41pc, from closer to 14pc a day ago.

The pound was flat against the euro, which is worth 84.4p.

09:56 AM BST

PwC fined and banned from China over Evergrande audit

PwC has been fined 441m yuan (£47.3m) and banned from operating in China for six months over its auditing of the collapsed property giant Evergrande.

In its steepest penalty against a Big Four accounting firm, China’s Ministry of Finance imposed a six-month business suspension on PwC’s auditing unit.

It also imposed a fine of 116m yuan (£12.4m) on PwC Zhong Tian LLP, the registered accounting entity and the main onshore arm of PwC in China.

China’s securities regulator said in a separate statement that it confiscated the unit’s revenue involved in the Evergrande case totalling 27.7m yuan and fined the unit 297m yuan.

Evergrande has struggled to repay creditors for years and became the symbol of China’s massive property crisis after defaulting in 2021.

It became subject to a winding-up order handed down by a Hong Kong court earlier this year.

09:38 AM BST

Paddy Power to buy majority stake in Brazilian gambling group

Paddy Power owner Flutter has agreed to buy a majority stake in a Brazilian betting company as it continues its global expansion.

Flutter told shareholders it will snap up a 56pc stake in NSX Group, which runs the Betnacional brand in Brazil, for around $350m (£266m).

It follows reports last month that Flutter had entered talks with the country’s fourth biggest gambling operator.

The move comes ahead of the launch of the regulated betting market in Brazil in January next year.

As part of the deal, Flutter’s existing Betfair Brazil business will combine with NSX to form Flutter Brazil.

Bosses added that they will be able to increase Flutter’s ownership stake in NSX through options five years and 10 years after the deal has completed.

Flutter shares were down 0.8pc.

09:18 AM BST

Miliband: Nationalised electricity grid will provide ‘impartial’ expertise

As the Government announced it is buying the operator of Britain’s electricity grid for £630m, Energy Secretary Ed Miliband said:

Today marks a milestone for Britain’s energy system as we bring the system operator into public ownership to provide impartial, whole-system expertise on building a network that is fit for the future.

The new National Energy System Operator has a huge role to play in delivering our mission to make Britain a clean energy superpower.

This is another step forward by a Government in a hurry to deliver for the British people.

John Pettigrew, chief executive of National Grid, said: “We look forward to working together with NESO to continue to drive the UK’s energy transition forward at pace; accelerating the decarbonisation of the energy system for the digital, electrified economies of the future.”

08:54 AM BST

FTSE 100 rises amid renewed bets on steeper US rate cuts

The FTSE 100 has risen as investors raised their bets of a hefty US interest rate cut next week.

The blue-chip index edged up 0.1pc, with gains limited as a strong pound hurt its export-oriented companies. Meanwhile the mid-cap FTSE 250 rose 0.3pc, aiming for its first weekly gain in three.

Precious metal miners Fresnillo, Endeavour and Centamin gained about 2pc each as gold scaled a record high against a weaker dollar.

Industrial metal miners rose 0.9pc as copper prices rose to a two-week high amid expectations of fiscal support from China.

The sterling touched a one-week high against the US dollar after the Wall Street Journal and the Financial Times reported it might be a close call on whether the US Federal Reserve cuts rates by a quarter of a percentage point or half a percentage point at its meeting next Wednesday.

That prompted traders to boost their expectations of a steeper half a point rate cut - or 50 basis points - to 44pc from just 17pc a day earlier, according to CME’s FedWatch tool.

An influential former New York Fed President, Bill Dudley, later said, “there’s a strong case for 50”.

Among other stocks, Vodafone’s £15bn merger with Three UK could push up bills for millions of mobile customers, Britain’s competition regulator said. Vodafone shares rose 0.3pc.

Flutter Entertainment edged lower after the Irish betting giant said it will buy a 56pc stake in NSX Group, the operator of Brazilian gaming group Betnacional, for about $350m (£266m).

08:36 AM BST

China to raise retirement age amid flagging economy

China will raise its retirement age for the first time since 1978 as it grapples with a slowing economy and an ageing population.

The extension was considered long overdue as it remains among the youngest in the world’s major economies.

The policy change will be carried out over 15 years, with the retirement age for men raised to 63 years, and 55 and 58 years for women depending on their jobs.

The current retirement age is 60 for men, and 50 for women in blue-collar jobs and 55 for women in white-collar jobs.

Xiujian Peng, a senior research fellow at Victoria University in Australia, said: “We have more people coming into the retirement age, and so the pension fund is (facing) high pressure, that’s why I think it’s now time to act seriously.”

Meanwhile, it has been another tough day for China’s stock markets amid worries about the state of the world’s second largest economy.

China’s CSI 300 index dropped 0.4pc to its lowest level since 2019, while the Shanghai Composite fell 0.5pc to its weakest point since February.

#China doom deepens w/CSI 300 drops to lowest since 2019. pic.twitter.com/WsV5WBFYXU

— Holger Zschaepitz (@Schuldensuehner) September 13, 2024

08:27 AM BST

Government buys electricity grid operator in £630m deal

The Government is to buy the operator of the UK’s electricity network from National Grid in a deal that paves the way for a nationalised energy system.

National Grid has sold the Electricity System Operator (ESO) to the Government in a deal worth £630m.

The move is part of the launch of the new National Energy System Operator (NESO) - a public body designed to aid the UK’s clean energy transition and support energy security.

The Department for Energy Security and Net Zero said the new body will launch on October 1 following the deal with National Grid.

National Grid said the “final cash consideration” for the sale is still subject to potential adjustments before the deal closes.

The new state-owned body will bring together planning for the UK’s electricity and gas networks under one roof, following the passage of the Energy Act in October last year.

The NESO will be chaired by former E.ON chief executive Paul Golby, with Fintan Slye as its chief executive.

08:19 AM BST

Female bosses delay or scrap expansion plans over funding fears

Almost one in five female business leaders have been forced to scrap or delay their company plans due to difficulties in securing financing, according to new research.

A survey commissioned by HSBC laid bare the difficulties facing women entrepreneurs, with one in 10 saying that securing the financial support they need was their number one challenge.

The poll of over 1,000 female business owners revealed that nearly half of them are planning to expand their businesses in the UK or overseas next year, but that many are being held back by not being able to access loans or financing.

Nearly one in five (18pc) female business leaders see access to funding as a barrier to growing their business, while the research also found that nearly a fifth (19pc) have had to postpone or altogether cancel their business plans as they have not been able to access the funding needed.

HSBC unveiled plans to boost the bank’s funding available for British female leaders by £250m as part of a wider initiative to tackle the issue and “unlock growth opportunities for women-led businesses”.

Stephanie Betant, head of global trade solutions and lead sponsor for women-led business at HSBC UK, said:

Without sufficient credit lines, women are too often forced to sit on their innovative business ideas and growth plans, or cancel them completely.

At HSBC UK, we want to drive meaningful change by using our financial expertise and global network to help women-led businesses realise their full potential, helping them to achieve growth and create a stronger economy.

08:07 AM BST

UK markets open higher

The FTSE 100 began the day higher following a rally on Wall Street that sent US stocks close to record highs.

The UK’s blue chip index rose 0.1pc to 8,250.09 while the midcap FTSE 250 lifted 0.3pc to 20,763.74.

07:57 AM BST

Boeing ‘can survive paying workers a little more’

Joe Philbin, a structural mechanic who has been at Boeing for six months, said he will work side jobs if the strike action drags out.

However, he said that he and his wife have been holding off on having kids until the situation stabilises.

He said:

Striking isn’t ideal, but it’s for the best for your long-term well being.

(Boeing) is a huge company, they can survive paying the people who do the work a little more.

07:45 AM BST

Boeing strikes risk $3.5bn hit to cashflow

The strike by Boeing workers could impact production of the company’s best-selling airliner until mid-November and cost the manufacturer $3.5bn (£2.7bn) in cashflow, according to analysts.

The walkouts will stop production of the 737 Max, and will also hit the 777 or “triple-seven” jet and the 767 cargo plane at factories in Everett and Renton, Washington, near Seattle.

It likely would not affect Boeing 787 Dreamliners, which are built by nonunion workers in South Carolina.

TD Cowen aerospace analyst Cai von Rumohr said it is realistic based on the history of strikes at Boeing to figure that a walkout would last into mid-November, at which point workers’ $150 weekly payments from the union’s strike fund might seem low in the run-up to Christmas.

A strike that long would cost Boeing up to $3.5bn in cash flow because the company gets about 60pc of the sale price when it delivers a plane to the buyer, Mr von Rumohr said.

He added that many union members are still bitter about previous concessions on pensions, health care and pay. He said:

They are upset. They have a lot of things they want. I think Boeing understands that and wants to satisfy a fair number of them.

The question is, are they going to do enough?

07:37 AM BST

Boeing ‘committed’ to new pay talks

Boeing has said it is ready to get back to negotiations to reach a new agreement after its US West Coast factory workers voted to go on strike rather than accept a 25pc pay rise.

The planemaker said:

The message was clear that the tentative agreement we reached with IAM leadership was not acceptable to the members.

We remain committed to resetting our relationship with our employees and the union, and we are ready to get back to the table to reach a new agreement.

07:35 AM BST

Vodafone urges regulator to approve £15bn deal

Vodafone and Three UK have said they disagree with the competition regulator’s concerns over their planned £15bn merger, saying it was “time to take off the handbrake on the country’s connectivity”.

Margherita Della Valle, Vodafone’s chief executive, said:

Our merger is a catalyst for change.

It’s time to take off the handbrake on the country’s connectivity and build the world-class infrastructure the country deserves.

We are offering a self-funded plan to propel economic growth and address the UK’s digital divide.

The companies also stressed it was not a final decision and they plan on working with the CMA to secure approval.

07:30 AM BST

Vodafone and Three merger raises competition concerns

A major merger planned between networks Vodafone and Three UK could lead to higher bills for tens of million of customers or give mobile users a reduced service, the UK’s competition watchdog has found.

The Competition and Markets Authority (CMA) has been investigating the £15bn deal since it was announced last summer.

The CMA said it had particular concerns that price hikes or reduced service would affect people least able to afford a mobile phone.

It also found the merger of the two firms could improve the quality of mobile networks, but it had concerns the incentive to follow through with planned investments after the merger was uncertain.

Vodafone and Three UK have the opportunity to address the CMA’s concerns before it issues a final report in December.

07:28 AM BST

Boeing workers to strike after rejecting 25pc pay increase

Boeing workers have voted to go on strike after rejecting a 25pc pay rise.

Staff at the troubled planemaker voted by 96pc in favour of the walkouts which will halt production of its strongest-selling 737 MAX jet at its sites in the Seattle region of the US.

The union members’ first strike since 2008 comes weeks after new chief executive Kelly Ortberg was brought in to restore faith in the manufacturer after a door panel blew off a near-new 737 MAX mid-air in January.

Members of the International Association of Machinists and Aerospace Workers (IAM) voted by 94.6pc to reject a contract that would have raised pay 25pc over four years, and then voted by 96pc to strike.

The pay deal included a $3,000 signing bonus and a pledge to build Boeing’s next commercial jet in the Seattle area, provided the program was launched within the four years of the contract.

However, it fell short of the union’s initial demand for pay raises of 40pc over three years.

IAM District 751 president Jon Holden said: “This is about respect, this is about the past, and this is about fighting for our future.”

Chase Sparkman, a quality-assurance worker, said: “As you can see, the solidarity is here.

“I’m expecting my union brothers and sisters to stand shoulder to shoulder, arm in arm, and let our company know that, hey, we deserve more.”

New Boeing boss Mr Ortberg said: “For Boeing, it is no secret that our business is in a difficult period, in part due to our own mistakes in the past.

“Working together, I know that we can get back on track, but a strike would put our shared recovery in jeopardy, further eroding trust with our customers and hurting our ability to determine our future together.”

07:24 AM BST

Good morning

Thanks for joining me. Boeing workers have voted to go on strike after rejecting a £25,000 pay rise in another setback for the troubled planemaker.

Around 30,000 members of the International Association of Machinists and Aerospace Workers voted by about 96pc in favour of the strike, which is due to begin at one minute after midnight on the US West Coast.

5 things to start your day

1) British-born population to be in decline from 2035 | Deaths will consistently outnumber births in Britain from the middle of the next decade

2) Britain’s choice: spiralling debt, £40bn in spending cuts or tax rises every 10 years | Spending watchdog issues stark warning as UK struggles under £2.5 trillion debt pile

3) Low-skilled migrants cost taxpayers £150,000 each | Pressure on public services outweighs tax take for low-earners, finds OBR

4) Musk has turned Twitter into ‘hyper-partisan hobby horse’, says Nick Clegg | Former deputy PM claims platform has been reduced to elite people ‘yelling at each other’ about politics

5) Scotland’s last oil refinery to close over net zero petrol car ban | Hundreds to lose jobs as Jim Ratcliffe’s Ineos prepares to shut Grangemouth

What happened overnight

Asian stocks were mixed after stocks in the United States pulled closer to their records following a couple of economic reports that came in close to expectations.

Japan’s benchmark Nikkei 225 slipped 0.9pc in morning trading to 36,491.80 after a 3.4pc increase Thursday.

The Japanese yen strengthened against the dollar, which fell to 141.05 from 141.79, adding pressure on the nation’s export trade.

Hong Kong’s Hang Seng added 1.1pc to 17,422.75, while the Shanghai Composite edged down 0.1pc to 2,714.77.

China is set to release its monthly economic data on Saturday, with market predictions that the three key indicators — industrial production, fixed asset investment, and retail sales — will show a slowdown.

Elsewhere, Australia’s S&P/ASX 200 rose 0.3pc to 8,096.00. South Korea’s Kospi shed 0.1pc to 2,568.41.

Wall Street’s main indexes closed higher on Thursday after new inflation data reinforced expectations for a 25-basis point rate cut by the Federal Reserve next week.

The S&P 500 gained 41.63 points to 5,595.76. The Dow Jones Industrial Average rose 235.06 to 41,096.77, while the Nasdaq jumped 174.15 to 17,569.68.