Five alternatives to Mag 7 stocks if you missed out on Nvidia

After propelling markets to record highs in the first half of 2024, the mega cap tech companies that have dominated Wall Street are now grappling with the aftermath of a global selloff that has wiped nearly $1tn (£755bn) off their combined market value.

The so-called “Magnificent Seven” — a term inspired by the classic Western film and popularised on Wall Street — includes tech behemoths Alphabet (GOOG), Amazon (AMZN), Apple (AAPL), Meta (META), Microsoft (MSFT), Nvidia (NVDA), and Tesla (TSLA). These companies were instrumental in driving the S&P 500's (^GSPC) gains last year, with a Morgan Stanley report highlighting that these seven companies alone accounted for half of the index's total return.

The combined market capitalisation of the Magnificent Seven exceeds that of the entire stock markets of the UK, Japan, France, China, and Canada combined. However, this group has recently encountered significant setbacks. Six of the seven companies have reported their second-quarter earnings, and the results have fallen short of the lofty expectations set by investors.

Tesla, for instance, saw its earnings plummet by more than 40%, despite surpassing sales forecasts. Amazon’s share price plunged 11% following its earnings announcement. Growing concerns about the health of the US economy also fuelled a wave of selling across global markets.

Read more: How to invest in the Indian stock market

"Coming into this earnings season, the 'Magnificent Seven' stocks were up against almost impossible expectations of beating perfection," Anna Rathbun, chief investment officer at CBiz Investment Advisory Services, said. "So in some ways, it's not surprising to see some sell-off here."

There are also cases where the Mag 7 are just too expensive. Nvidia's valuation surged to such heights that it became out of reach for many value investors. Back in July the company decided to conduct a 10-for-1 stock split, when it was trading at around $1,210, to make its stock more accessible to a broader range of investors. It is now trading at around $120 as the countdown continues to its earnings.

The $3.2tn (£2.4tn) chipmaker will set the tone for tech stocks when it reports later on Wednesday, serving as a bellwether for AI spending and other companies' investment into new technologies.

As the AI rally enters a crucial stage, investors are left to consider where to look for alternatives to diversify their portfolio or undervalued stocks that might benefit from artificial intelligence. Here are some companies to have on your radar.

Five alternatives to the Magnificent Seven

ASML (ASML)

The AI rally has been driven by the need for the world’s most advanced chips. Dutch company ASML manufactures lithography machines essential for producing them.

While not a household name, ASML should be on any investor’s radar who is looking to capitalise on the growth of artificial intelligence.

ASML is virtually the only provider of extreme ultraviolet (EUV) lithography machines, which are critical to the production of silicon-based microchips. Its clients include semiconductor giants like TSMC (TSM) and Samsung (005930.KS).

When ASML published its quarterly results in July, Dan Coatsworth, investment analyst at AJ Bell, said: “ASML is further proof that the AI boom still has legs. Demand is soaring for the semiconductor equipment maker.”

Despite a recent share price pullback, the current price of around $920 is more than 20% below analysts' consensus target of $1,194, and the vast majority of analysts still consider the stock a strong buy.

“Companies across countless industries are investing heavily in AI, which means chipmakers have the confidence to build more manufacturing plants,” Coatsworth added. “That feeds into greater demand for ASML’s equipment, which plays a crucial role in the production of computer chips.”

However, weaker-than-expected third-quarter guidance has negatively impacted the stock. Nearly half of ASML’s sales still come from China, making geopolitical risk a significant concern for investors.

Read more: How likely are multiple Bank of England interest rate cuts this year?

ASML is also part of the "Granolas" — a group of "internationally-exposed quality growth compounders" and Europe’s answer to the Magnificent Seven, according to Goldman Sachs. So named for the combined first initials, which spell Grannnllass, the eleven companies are GlaxoSmithKline (GSK.L), Roche (ROG.SW), ASML, Nestle (NESN.SW), Novartis (NOVN.SW), Novo Nordisk (NVO), L'Oreal (OR.PA), LVMH (MC.PA), AstraZeneca (AZN.L), SAP (SAP) and Sanofi (SNY).

Novo Nordisk (NVO)

Novo Nordisk, another member of the Granolas, is currently Europe’s largest company by market capitalisation and, unlike the Magnificent Seven, is not exposed to the tech sector. This could be an attractive option for those who believe that AI is a bubble or simply want diversification.

The Danish firm makes the weight loss and diabetes drugs Wegovy and Ozempic, which have gained widespread popularity, including among celebrities such as Tesla (TSLA) CEO Elon Musk and TV personality Oprah Winfrey.

Sam North, market analyst at eToro, told Yahoo Finance UK: "Novo Nordisk emerges as a standout option in Europe. The Danish pharmaceutical giant has gone from strength to strength over the last few years and is currently the largest stock in Europe by market capitalisation.

“Analysts are optimistic about Novo Nordisk's performance, particularly with its blockbuster weight loss drug, Wegovy. The company reportedly sold 10.4bn Danish kroner (£1.2bn) worth of Wegovy in the first quarter alone, more than doubling its sales from the same period last year."

He added: “From a technical analysis standpoint, there are a couple of levels that I think act as a good guide of sentiment for the bulls to focus on. The 740 DKK level offers a potential entry point for those looking to buy on dips, while a move above 928 DKK could signal a push towards its previous all-time high. In an environment where timing the market is challenging, Novo Nordisk stands out as a resilient and promising addition to any portfolio.”

Novo Nordisk’s shares have surged around 260% since launching Wegovy in the United States in June 2021. The company’s market value of £455bn now exceeds the size of the entire Danish economy.

LVMH (MC.PA)

Though LVMH has lost its crown as Europe’s largest company to Novo Nordisk, it remains a heavyweight contender.

Despite challenges in the consumer discretionary sector, LVMH has continued to deliver strong profits, with an operating margin of 25.6% in the first half of the year, well above pre-COVID levels. This translated into €10.7bn (£9.02bn/$12bn) in operating profit. Additionally, its free cash flow increased by 74% to €3.13bn, or 7.5% of revenue.

The stock has pulled back on slowing growth and is trading at a price-to-earnings ratio of 22:2.

LVMH's diversified conglomerate model, which includes brands like Tiffany, Dior, Fendi, Givenchy, Marc Jacobs, and Sephora, allows it to tap into different luxury segments.

Growth is also likely to improve as inflation and interest rates continue to fall globally.

Snowflake (SNOW)

Returning to the US and the tech sector, Snowflake is well-positioned to benefit from the AI rally. Snowflake’s CEO Frank Slootman said: “There is no AI strategy without a data strategy.”

The company focuses on data management services, collecting and analysing an organisation’s data to deliver insights that help businesses grow. The rise of AI has made this data even more valuable.

The demand for Snowflake’s data management platform has driven strong revenue growth. In its 2024 fiscal year, Snowflake achieved $2.8bn in sales, up 36% from the prior year’s $2.1bn. The company expects its revenue to continue expanding, estimating $3.3bn in sales for fiscal 2025.

However, analysts remain cautious, which could mean the share is currently undervalued.

“Waning optimisation headwinds and emerging new product initiatives should support growth, but investors may need more concrete signals to get on board,” said Morgan Stanley analyst Keith Weiss in a report.

Seven analysts have a "strong buy" recommendation for Snowflake’s shares, and 24 rate it as a "buy", according to Yahoo Finance data. The market consensus sees the share price trading at $166, higher than the current $118, with $220 as the high range for the stock.

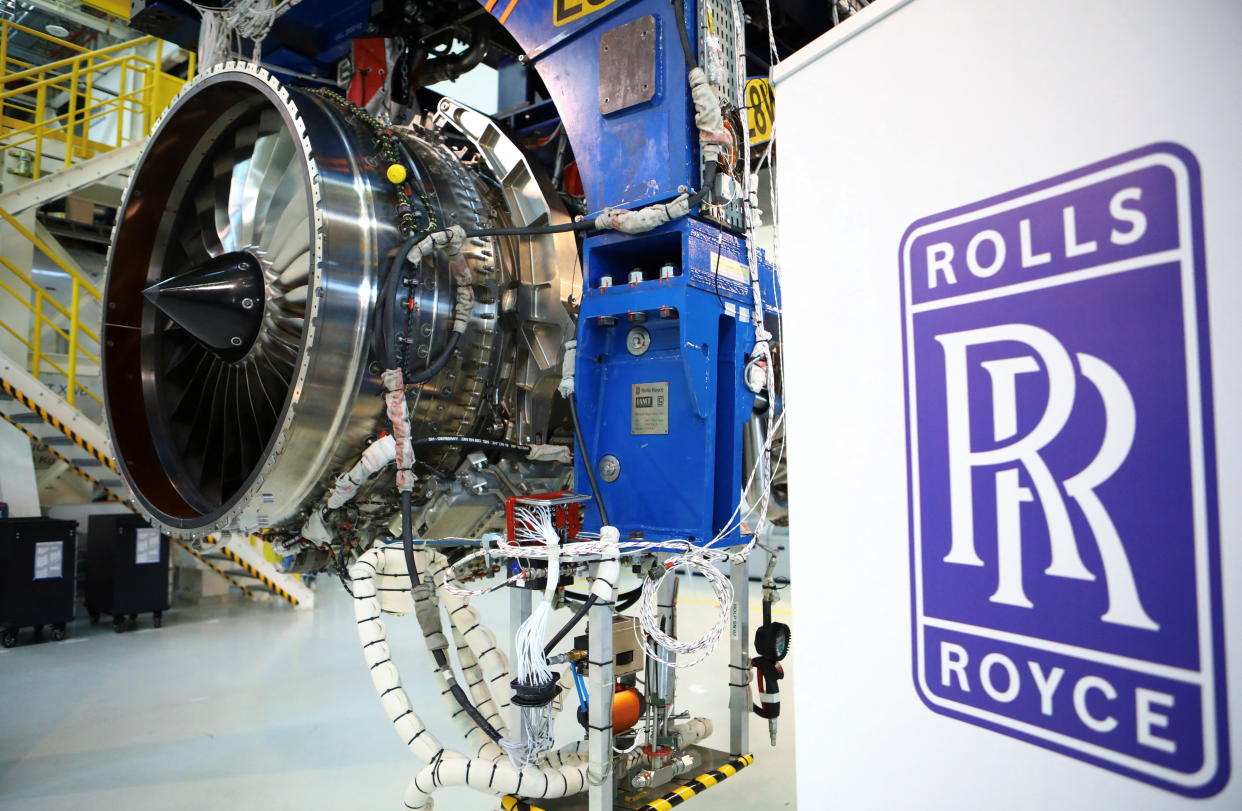

Rolls Royce (RR.L)

It is not part of the Magnificent Seven, it does not list under Europe’s Granola’s and it is part of the FTSE 100 (^FTSE), which Nvidia alone has overtaken in value. So how can Rolls Royce be a Mag 7 alternative?

The company has delivered a total shareholder return of 221% over the past year, matching Nvidia's performance. This surprise achievement reflects growing investor confidence in the turnaround plan laid out by new CEO Tufan Erginbilgic.

His vision for Rolls-Royce is ambitious, aiming to transform the company into a leaner, more profitable enterprise with a bright future. Erginbilgic’s has set out to achieve a dramatic increase in adjusted operating profits from about £250m to between £2.5bn and £2.8bn by 2027.

This growth is underpinned by a strategy to unlock £2bn in working capital savings, primarily through better inventory management. These efficiencies are expected to help the company boost free cash flow from £500m to between £2.8bn and £3.1bn over the next five years.

Since Erginbilgic joined, shares have more than quadrupled to top London’s premier index. That rally is made all the more remarkable given the struggles that gripped Rolls-Royce in the years prior, which included a very close brush with bankruptcy during the pandemic.

The biggest turnaround is expected to happen at the civil aviation business, which accounts for nearly half of group sales. The rest of its revenues are split relative evenly between Rolls-Royce’s defence and power systems divisions.

Erginbilgic believes civil aviation’s adjusted operating margins can be lifted from 2.5% to between 14.5% and 16.5% by 2027. While the improvement looks dramatic, these levels of profitability are comparable to those of some rivals.

The current price-to-earnings (P/E) ratio of Rolls-Royce stands at 18. While some investors may argue that this valuation isn't cheap, it's also not particularly expensive for a blue-chip company within the FTSE 100.

Download the Yahoo Finance app, available for Apple and Android.