‘Half my £380k retirement fund is in HSBC shares – should I sell?’

Would you like Victoria to rate your portfolio? Email money@telegraph.co.uk with the subject line: “Rate my portfolio”. Please include a breakdown of your portfolio, your age and what your investing goals are. Full names will not be published.

Dear Victoria,

I am a 70-year-old pensioner and have a portfolio essentially from the days of privatisation as well as a cash Isa worth £50,000.

Please can you help me turn this mish-mash into a current and relevant portfolio?

Thank you.

Regards,

Sharath

Victoria says:

Dear Sharath,

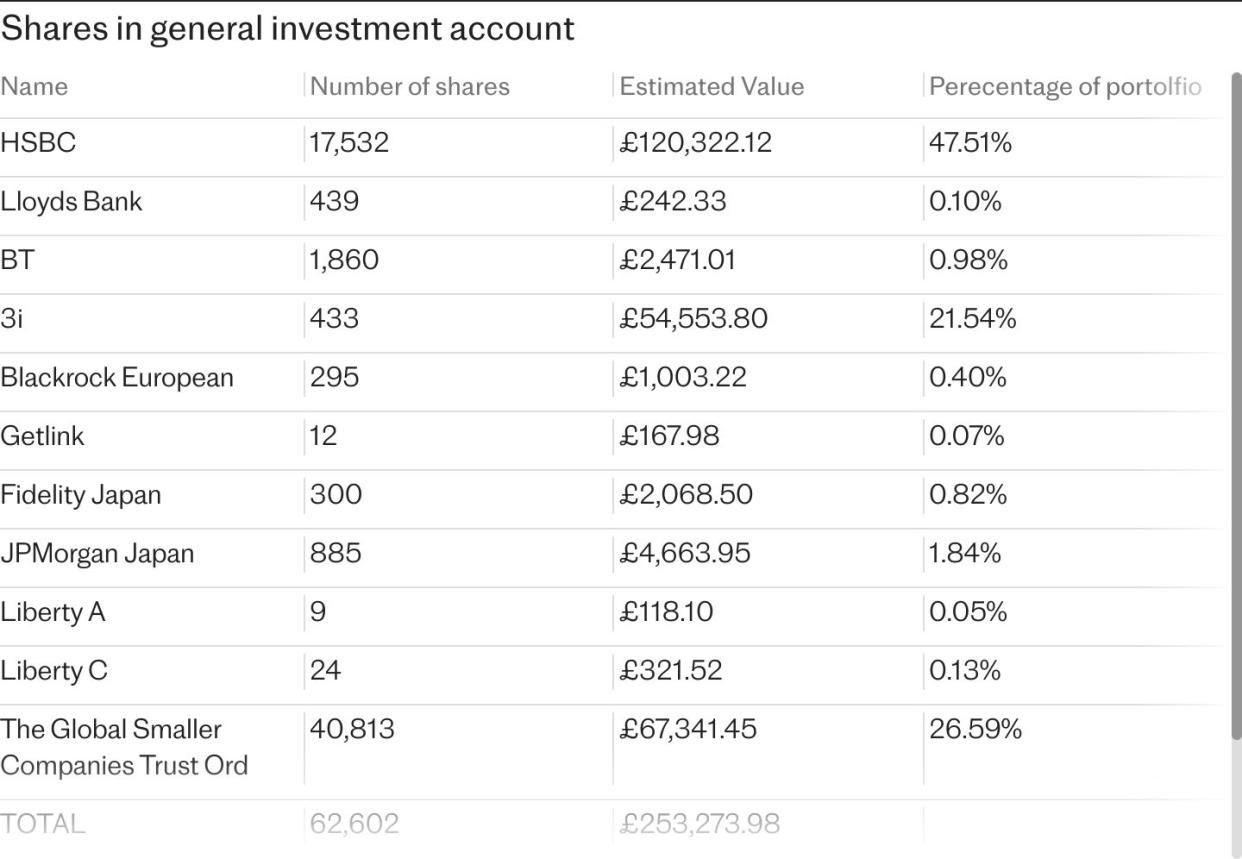

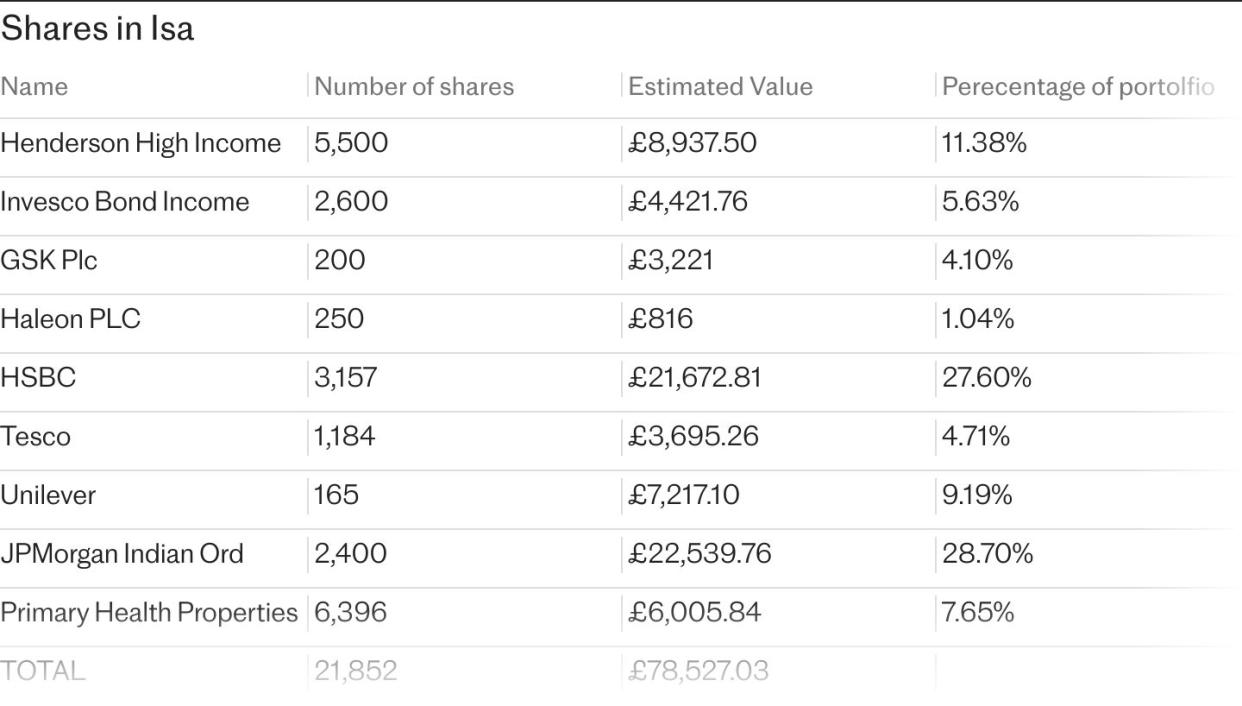

I’m pleased to see you’re using your tax-free Isa allowance and it’s great to see you’ve accumulated investments worth around £380,000 according to my calculations

Your portfolio could certainly do with a bit of TLC and modernisation.

Digging into your portfolio, I notice you have some very large positions such as in HSBC which accounts for over 45pc of your share portfolio and almost a third of your Isa.

It’s far too risky to have so much wealth in a single company.

There’s no denying the stock has performed well lately – it is up by more than 10pc over the past year and it has an attractive dividend yield of over 7pc.

But I’d suggest de-risking your portfolio and diversifying into a global financials fund instead, if you still want exposure to the banking sector.

Take a look at Polar Capital Global Financials Trust which aims to generate a growing dividend income as well as capital appreciation by investing in a global portfolio of financial stocks.

It has an impressive track record having been a top quartile performer over a one-, three- and five-year time horizon.

Aside from HSBC, I’d argue your exposure to India is also too high.

Your holding of JPMorgan India accounts for almost a third of your entire Isa. While India has performed very well lately, the market can be extremely volatile and a position of this size is far too risky, especially during your pension years when you should be focusing on preserving wealth and sourcing income.

Just take this week as an example – stocks in India sold off heavily as election results trickled out.

Emerging market funds should only be a small satellite position rather than a core holding. Our funds team like Pacific Assets, JPMorgan Emerging Markets and Utilico Emerging Markets for wider EM exposure. Consider switching to one of these funds instead with a smaller percentage allocation.

At the other end of the size spectrum, you have some tiny positions such as around £118 in Liberty A or 0.05pc of your share portfolio and in your Isa you’ve got about 1pc or just under £820 in Haleon. Those very small holdings won’t move the needle so aren’t much use to you.

Therefore you might like to think about either selling these to simplify things, or consider building up a meaningful allocation to an appropriate percentage, say around 3pc-5pc which would make much more sense as part of a diversified portfolio.

In terms of other nips and tucks, I’d argue you don’t need to hold both Liberty A and Liberty C.

There isn’t much need for two different share class versions of the same stock, and you want to make things as simple as possible for yourself.

In the same vein, you probably don’t need two different Japan funds either – at the moment you’ve got Fidelity Japan Trust and JPMorgan Japanese Investment Trust.

The JPMorgan trust is a better performer over one, three, five and 10 years, with less volatility over the past three years.

I’m not an expert on either of these funds but a quick scan of the data suggests to me that JPMorgan has been better managed – so why not do some more research and consider consolidating into one strategy

Now that we’ve covered some tweaks to your portfolio, let’s focus on the more important part – choosing the major building blocks that should comprise the lion’s share of your portfolio.

A big thing to think about is whether you are investing for income, growth, or a mixture of the two.

I’d hazard a guess, given that you’re in retirement and are likely looking for supplementary earnings, that income is probably a key investment focus for you.

I would suggest looking at the 10 investment trusts that are part of an exclusive club that have consistently raised their dividends for 50-plus years.

You already own one, The Global Smaller Companies Trust – other “dividend heroes” to consider include City of London, JPMorgan Claverhouse, and Murray Income Trust, which respectively yield 4.9%, 4.9% and 4.4%.

The trio all invest in the UK.

For more global exposure (which tends to serve investors well), consider dividend hero Alliance Trust. It is a multi-manager strategy, outsourcing the stock picking to external fund managers.

The yield is lower than the UK trust trio, at 2.1pc, but due to its healthy rainy day fund (called revenue reserves) it is in a great position to continue its progressive dividend policy for years to come, even if there is an income famine.

Revenue reserves enable investment trusts to bolster dividend payouts in leaner years so are a nice hedge against market and economic volatility.

While you do have some exposure to bonds, now may be time to consider adding some more. Rising interest rates have put bonds back on the agenda for both retail and professional investors. Yields are now well ahead of the UK inflation rate, at about 4pc for gilts and 5.5pc for investment-grade bonds, with high-yield bonds offering even more than that.

In addition, with interest rates likely at their peak bonds should also see their capital values increase as borrowing costs come down.

Investors looking to take advantage of bonds potentially about to have their moment in the sun, could turn to a bond fund where the fund manager has the freedom to scour the globe for the best fixed-income opportunities.

Two funds recommended by our team of fund analysts are Jupiter Strategic Bond and M&G Global Macro Bond, which yield 5.2pc and 4pc respectively.

If you’d like to supplement your dividend and bond holdings with a growth element to your portfolio too, I’d suggest a passive, low-cost global equities fund. Take a look at iShares Core MSCI World UCITS ETF which invests about 70pc in the United States and owns the largest 1,500 companies across developed markets.

On top of a few tweaks here and there mentioned above, I’d look to refocus your portfolio on some core dividend and bond fund holdings with the potential for a growth fund or two on top, depending on your risk appetite.

Then if you want to keep some of your single stocks or other riskier holdings such as in emerging markets, just make sure each only makes up a small percentage of your overall portfolio.

I hope your investment journey and retirement both go extremely well.

Victoria is head of investment at Interactive Investor.

Her columns should not be taken as advice or as a personal recommendation, but as a starting point for readers to undertake their own further research.