This tax has been tinkered with for 60 years – please Labour, leave it alone

Mike will be online on Tuesday at 6pm to answer your questions on how the election will affect your taxes. You can also email questions to: taxhacks@telegraph.co.uk.

Every chancellor wants to make their mark on history, particularly following a change in colour of the Government.

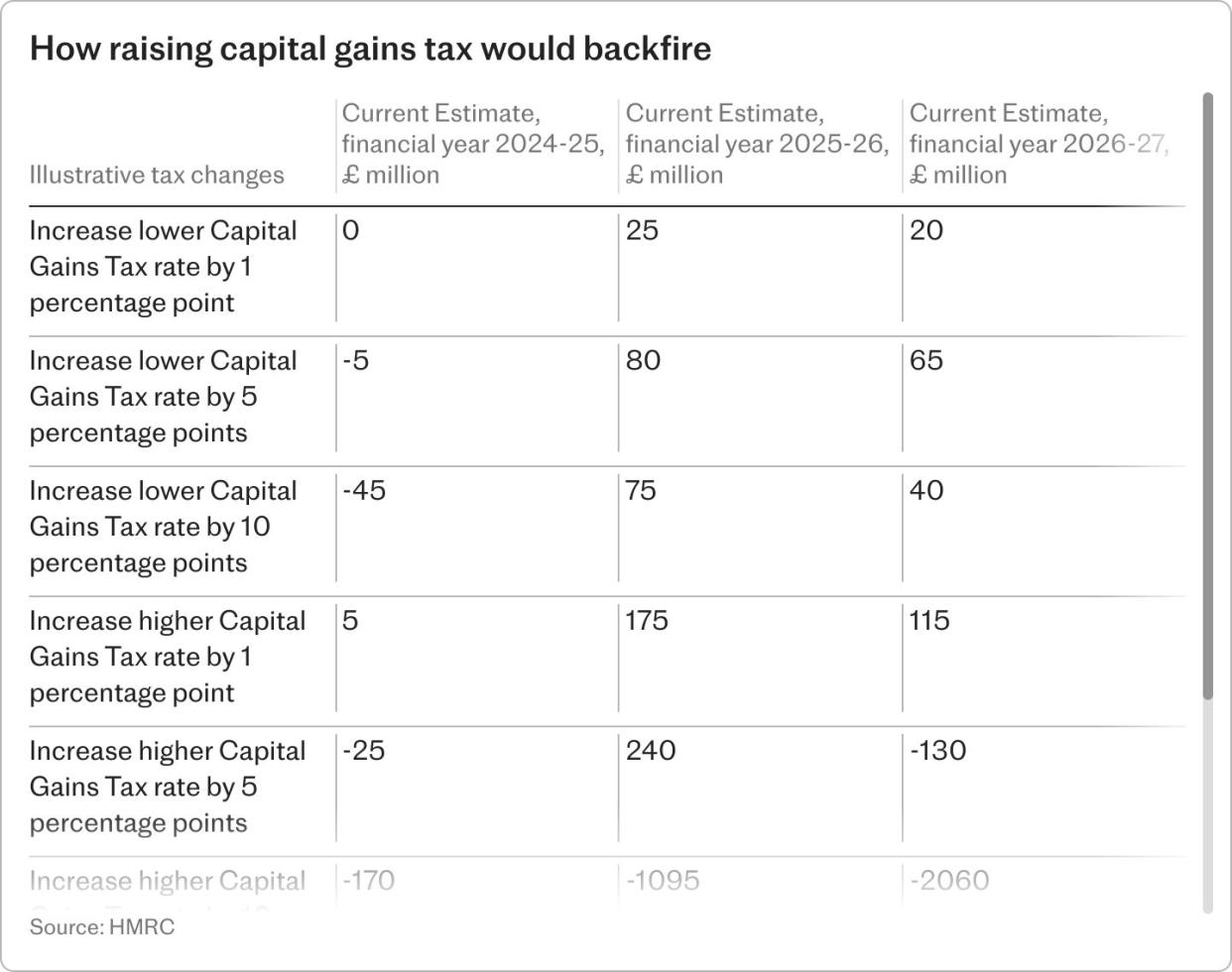

For some reason, capital gains tax (CGT) seems to be the most popular target for “reform”. However, as often as not, it results in no identifiable improvements and many times the wheel is simply reinvented. I suspect that after the election, CGT will again receive this treatment.

The main debate is with the age-old observation that tax rates on capital gains are lower than tax rates on income, which some argue is unfair. This approach overlooks several important factors.

Capital growth on assets typically accumulates over time, but a tax liability is only triggered on a disposal. This results in a bunching of the gain into a single tax year, which can drive up the tax rate applied.

In addition, the current rules make no allowance for the general rise in inflation over that time, so in practice, much if not all of the gain is due to general inflation rather than a real profit.

CGT is to a degree double taxation since the asset which has been purchased is often from income that has already been taxed, although that argument could equally be applied to most other forms of savings outside a pension fund or Isa.

Indeed, double tax applies when you make any purchase that includes VAT, and triple tax applies every time we fill up our cars with fuel because it carries duty on top of VAT.

Where shares are concerned, the gain is usually generated from profits on which the company will have already paid corporation tax.

Around 400,000 people pay CGT every year and both the number of taxpayers, and the amounts of CGT, have been increasing by about 15pc annually.

For the last year that data is available, capital gains of about £67bn were made on shares and other financial assets.

Of this, £41bn was on unlisted shares, typically unquoted businesses, with £13bn on property, largely residential second homes and buy-to-let investments. Commercial property is usually owned by companies where corporation tax, rather than CGT, would apply.

Inheritance tax, on the other hand, raised about £2.4bn in 2009-10 and £7.5bn last tax year and is forecast by the Office for Budget Responsibility to be £9.7bn by 2028-29.

That rise is, however, far exceeded by capital gains tax. In the 2009-10 tax year, CGT raised £2.5bn. Last year, it raised almost £17bn and is forecast to rise to £23.5bn by 2028-29.

These are big numbers and that is before any changes to the tax treatment, as is now anticipated.

There are several drivers of these large increases in inheritance and capital gains tax, including the growth in asset prices of property and shares plus the frozen £325,000 inheritance tax threshold.

For CGT, it also includes the dramatic reduction in the annual exemption from £12,300 in 2022-23 to just £3,000 this year.

Ownership and investment in private businesses has historically been encouraged by successive governments with a 10pc CGT rate applying up to lifetime gains of £10m. However, this was dramatically cut by the Conservative government in April 2020 to a lifetime limit of £1m.

Another proposal on CGT that is frequently put out by Left-leaning think tanks may now resurface.

When someone dies, inheritance tax applies but the CGT position is generally favourable. Specifically, there is no CGT at death and the assets are “rebased” to market value so that either the estate or the beneficiaries, typically the children, are able to sell them on with the benefit of the enhanced CGT “base cost”.

I do not think anybody is yet suggesting that the CGT death exemption should go but some have argued for beneficiaries inheriting the typically lower base cost at death, in a similar way that spouses take on the base cost on a gift from their partner.

I suspect that this is now on the list for discussion. If implemented, it may not have an immediate effect but it certainly would do by the end of the next Parliament.

When I started in tax in the 1970s, it was a case of earned income good – unearned income bad. The then Labour government applied an investment income surcharge of up to 15pc on interest and dividends.

I was relieved to hear that saving is not now to be discouraged, as we had feared from the comments of Sir Keir Starmer and his definition of “working people”. I once had a debate about saving with the great, and sadly missed, Denis Turner, the chief economist at HSBC.

He argued that one person’s savings was another person’s job. I am not a clever economist but disagreed with him because I regard saving as a wholly good thing. I accept that not everybody can afford to save but those who do reduce the need for their family or the state to step in later in life. It also allows some of their capital to be recycled into business investment.

Returning to my initial theme, before 1965 short-term capital gains were taxed as income but longer-term gains escaped tax. Clever minds found ways of converting income into capital and CGT was introduced in that year in part as an anti-avoidance measure to counter this. It usually applied at a flat rate of 30pc.

In 1988, Nigel Lawson decided to tax gains as income with the top rate at 40pc, but this was applied after an indexation allowance was made for inflation.

Gordon Brown changed the rules in 1998 by freezing the indexation allowance and introducing a flat rate again but with the benefit of taper relief, being a reduction in the taxable gain according to the length of ownership.

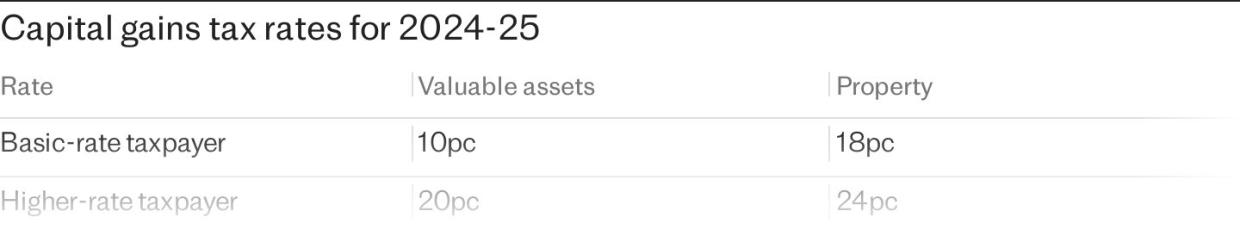

Then in 2010, Labour removed taper relief and set a flat rate of 28pc for higher-rate taxpayers, since reduced to 20pc on shares. For residential property, it was initially set at 28pc and has now dropped to 24pc.

In summary, we have endured a 60-year merry-go-round of “reforms” only to finish up largely where we started.

Labour says it wants stability. The party will have the opportunity to demonstrate this commitment by avoiding the temptation to carry out yet another reform of capital gains tax. We can but hope.

Mike Warburton was previously a tax director with accountants Grant Thornton and is now retired. His columns should not be taken as advice, or as a personal recommendation, but as a starting point for readers to undertake their own further research.