Rachel Reeves leaves door open to increase in capital gains tax

The shadow chancellor has left the door open to an increase in capital gains tax under a Labour government.

Rachel Reeves refused to deny her party could change the levy in its first Budget to spend more on public services.

Labour has ruled out any rises in income tax and National Insurance if it wins the election on July 4.

But at a press conference on Tuesday, Ms Reeves repeatedly failed to make the same commitment about capital gains tax, only saying she had “no plans” to increase the charge.

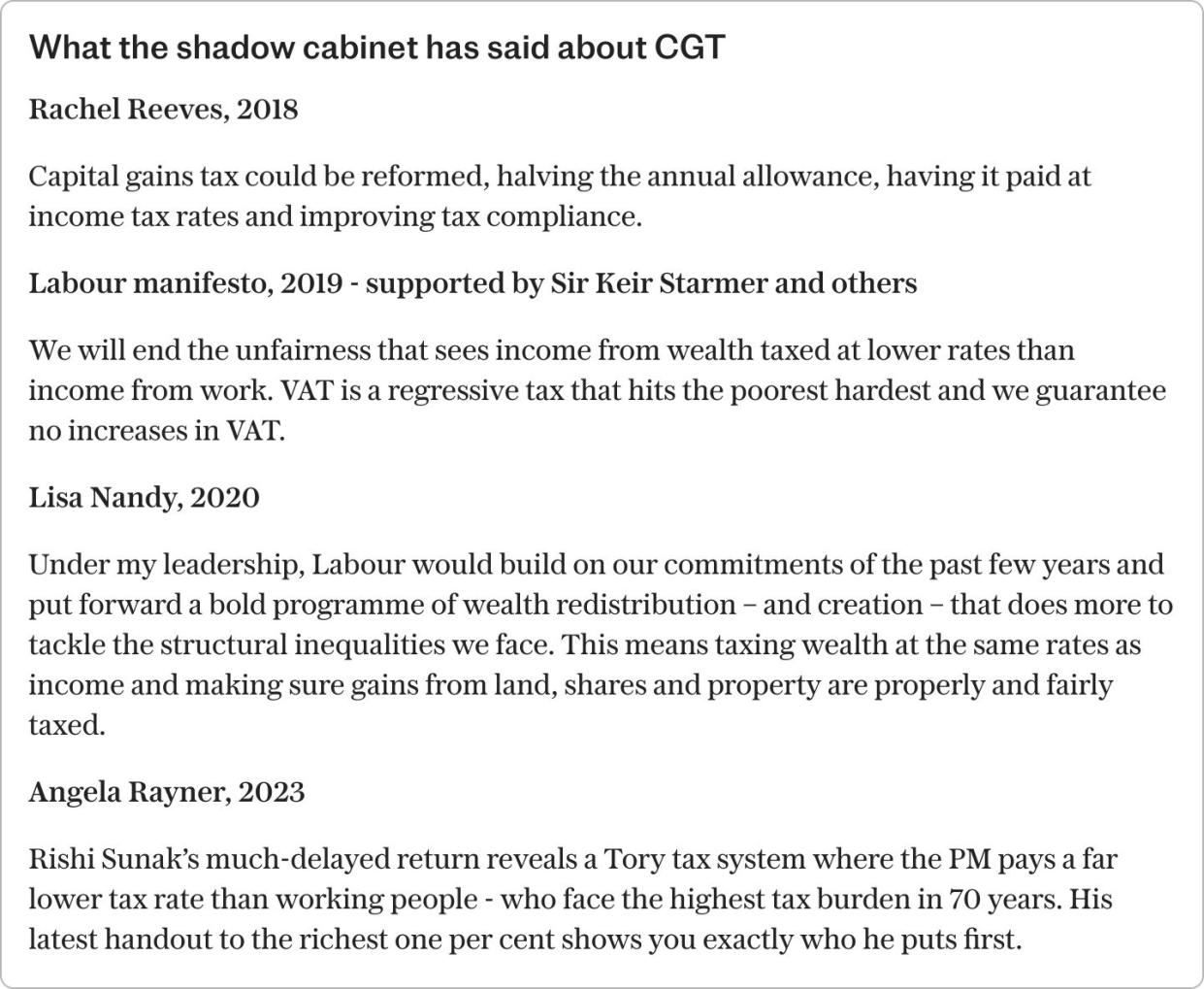

Asked about comments in 2018 in which she called to halve the CGT allowance to generate an extra £14 billion she replied: “Those are not Labour Party policies, they’re not my policies.”

Almost a third of the shadow cabinet has previously called for increases in CGT, including Ms Reeves.

Lisa Nandy, the shadow international development secretary, called for CGT rates to be increased to make them level with income tax when she stood to be Labour leader in 2020.

Six other frontbenchers - Sir Keir Starmer, Emily Thornberry, Jonathan Ashworth, Angela Rayner, John Healey and Baroness Smith - were in the shadow cabinet when Jeremy Corbyn stood on a manifesto which pledged to do the same.

Last year, Ms Rayner, Labour’s deputy leader, also suggested CGT rates should rise to income tax levels when she criticised Mr Sunak for his tax return which showed he paid an effective tax rate of 23 per cent on £2.2 million of income. This was because the majority of his earnings were capital gains, meaning it was taxed at 20 per cent.

In 2018, Ms Reeves wrote a pamphlet, saying: “Capital gains tax could be reformed, halving the annual allowance, having it paid at income tax rates and improving tax compliance.”

Asked about this on Tuesday, the shadow chancellor said: “Everything in our manifesto and everything in my plan is fully costed and fully funded. It does not require any additional increases in taxation.

“I want taxes on working people to be lower but unlike the Conservatives, I am not willing to announce a load of unfunded commitments on tax or spending, because frankly, they’re simply not believable unless you can say where the money is going to come from.”

Pressed on whether her use of the phrase “no plans” was intended to excuse any such tax rise once in government, she replied: “I don’t want to, and I have no plans to, increase any taxes beyond those which have already set out.”

Ms Reeves also denied having “changed my mind” since giving an interview to The Telegraph last year in which she ruled out increasing wealth taxes.

“I’ve already said we have no plans to increase CGT. I do not want to increase taxes, I want taxes to be lower, I want to grow the economy.”

On Tuesday morning, Wes Streeting, the shadow health secretary, had also failed to rule out changes to capital gains tax when asked repeatedly about Labour’s stance during his broadcast media round.

He told BBC Radio 4’s Today programme: “Our manifesto is out on Thursday but I can tell you that nothing in that manifesto requires an increase in capital gains tax.”

When asked again if he might reform the levy, he said he had to be “careful” about not preempting the manifesto but strongly suggested it would not include capital gains tax reform.

However, he failed to give any concrete assurances when asked another two times why he would not want to increase the duty on the sale of assets such as second homes.

The Conservatives have said that if they form the next government, landlords who sell their rental properties to the sitting tenants will be spared paying capital gains tax on the sale, a tax break worth an average of more than £21,000.

The 100 per cent tax break for landlords would be introduced for two years in an attempt to boost home ownership.

The Liberal Democrat manifesto, which was published on Monday, included a pledge to double capital gains tax to fund a £5billion-a-year rescue package for the NHS.